Synopsis of the week

- ON / OFF US and North Korean Nuclear peace talks have spooked the markets as investors are left baffled as to what is happening.

- The Turkish central bank was forced to increase interest rates by 3% as the Lira collapsed against the US Dollar.

- The Euro has fallen in value over the last month leaving the EUR/CHF rate down 3.25% back to 1.1620, having briefly popped above the 1.2000 level back in mid-April.

- As Oil prices have remained strong, OPEC has now agreed to increase supply to the market by 1 million barrels a day in an effort to prevent prices climbing any higher.

It was an interesting week for currencies as the Turkish Central Bank was forced to raise rates by 3% up to 16.5%. Many emerging market countries see small to medium-sized companies utilizing short-term US Dollar lending. The increasing interest rates in the US are now beginning to have more of an effect, making commodities more expensive and driving up inflation. This is not an issue that impacts Turkey alone and we will be watching to see how these pressures affect other emerging market currencies, therefore we are cautious of being too exposed to these sectors.

About a month ago when the EUR/CHF rate popped above the 1.2000, back to where the Swiss National Bank had previously pegged the currency, we did warn that this was a big psychological level and we could see a sell-off. One month on and we are down to 1.1625 levels a correction of 3.25%. Fern Wealth longer-term opinion is still that we will see EUR/CHF above 1.2000 and probably higher. These current moves offer clients another opportunity to rebalance their Swiss Franc exposure.

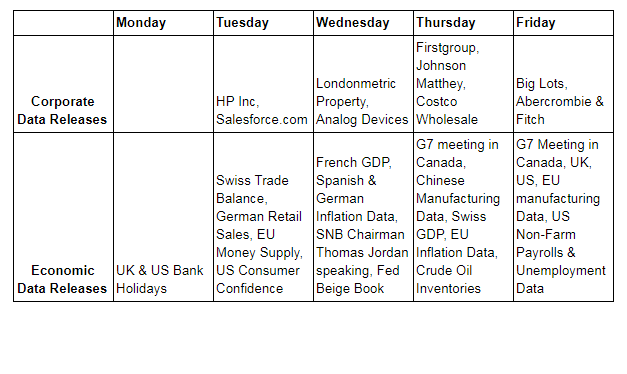

It will be a very quiet start to the week as both the US and the UK will be enjoying long bank holiday weekends and the FTSE, DOW, NASDAQ & S&P500 will all be shut on Monday. Even though it might not feel like it with all the lacklustre press sentiment to markets, it is worth noting the Dow, NASDAQ, S&P 500, FTSE, DAX & CAC are all now up on the year to varying degrees. In years gone by, the city saying of “sell in May and go away” did have some relevance as traders and investors went on summer vacations and left trading floors quieter. Markets these days are almost 24 hours a day and the seasonality of volumes is less of an issue as connectivity to online trading is global. History is never a guarantee about the future but when equity markets have been up on the year by the end of May they have then gone on to post full-year gains in over 90% of the time.

This week will see the G7 nations meeting in Canada for a two-day conference. Historically this has always been a very cordial event as these nations have seen their international opinions frequently being aligned. This time, however, as the US stands alone on its opinion towards global trade agreements we could see less of a unified policy stance.

Image by Gerd Altmann from Pixabay