Synopsis of the week

- This weekend has seen the US & China make progress on trade talks avoiding the threat of a trade war, at least for now.

- The US Dollar index continues to gather strength up by 5.25% in the last five weeks against a basket of all the other major global currencies.

- Oil prices have maintained their steady increase as worries over Iranian supply persist, pushing prices up 162% from their January 2016 lows and back to levels last seen in 2014.

- US 10 year treasury bond are now yielding up to 3.11%, their highest level since 2011 and finally beginning to offer a meaningful alternative to equities.

Press coverage

On Wednesday 16th May Alastair McCaig, our Head of Investment Management, joined Bloomberg anchor Jonathan Ferro and FX and Rates Strategist Richard Jones for their weekly look at the markets. This week, they discussed Italian politics and the bond markets reactions to potential policy decisions along with the latest developments in Brexit negotiations.

Click here to Listen to the interview on Bloomberg.

One of the biggest geopolitical worries markets have had this year has revolved around trade wars. This weekend has seen the US and China make some real progress around substantially reducing the America’s trade deficit with China. US Treasury Secretary Steven Mnuchin was quoted as saying “We are putting the trade war on hold”. Although China has not agreed to a numerical target it does appear that American goods, farm sales and energy products were at the forefront of these negotiations and we should expect to hear further announcements in the weeks ahead.

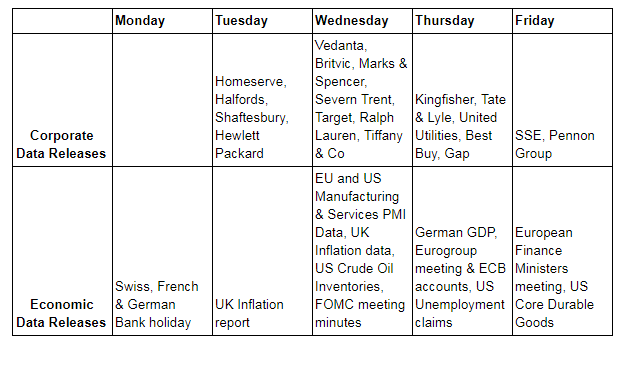

It will be a slow start to the week as Switzerland, France and Germany are all enjoying a Pentecost Monday bank holiday and global equity volumes will suffer because of this. The first challenge of the week will come on Tuesday when South Korean President Moon Jae-in visits Washington to discuss North Korea with US President Donald Trump. Considering the discussions will revolve around the delicate topics of North Korea and Nuclear weapons, this will be another test of the US President’s diplomacy skills. A month ago, the currency markets had given a 90% chance that the Bank of England would raise interest rates only for them to disappoint a couple of weeks later. Wednesdays inflation data will give markets more of an idea how far away the UK economy is from rectifying this. Also out on Wednesday, we will get EU & US manufacturing and Service data, some of the most important economic data. In the evening, we will then have an opportunity to look at the minutes of the last US FOMC meeting. These minutes will give currency markets a better idea of how the FED will proceed with interest rate rises throughout the rest of 2018. As the US continues to raise rates, we are becoming increasingly conscious of the growing gap in rate levels between the US and the other major economic regions such as the EU and UK and the potential risk to the US Dollar as a consequence.

Corporate data

The US reporting season has now come to an end but what can we see from all the data that has been released?

US corporate profits on average are higher than last years equivalent data by 18% and this is partially due to the fact 80% of companies have beaten market expectations. It is also worth noting that average sales figures are also 7.6% higher as consumer spending increases. This is the S&P 500’s strongest set of quarterly data since 2010. On average share prices have risen by just 0.1% even though the average increase historically has been by 1.1%. So why have the markets been so reluctant to reward companies for good announcements? In short, the markets are still hung up on all the geopolitical issues such as Syria, North Korea and Trump trade wars. Corporate data releases are also companies looking back on what has already happened rather than what will happen. We still believe that strong corporate data will be one of the factors driving equity prices higher but with investor confidence still fragile, we might have to wait for share prices to play catch-up.