Synopsis of the week

- The nomination of Jerome Powell was taken by the markets as a signal that the FED would continue on a steady path of rate rises, an environment that should continue to help US equity markets.

- For the first time in a decade, the Bank of England increased interest rates, but futures markets do not expect the next increase until September 2018.

- On Thursday the Republican party formally rolled out their tax plan for the US. If approved this would be the first major change to the US tax system in three decades partially explaining why it has taken the Trump administration so long to get this far.

Fern Wealth Seminar

On Tuesday 7th November at 6.30 pm Fern Wealth will be holding another of their successful seminars, the topic of which will be “Why you should be investing in funds and how to get started”. Light refreshments will be available and we anticipate an extremely interesting and socially pleasurable evening with the attendance of existing clients and interested parties.

Click here for further information and an ability to register

Press Coverage

On the evening of Wednesday 1st November Alastair McCaig, Head of Investment Management, joined Bloomberg hosts Charlie Pellet to discuss the Bank of England’s interest rate decision, President Trump’s preference for the next Fed Chair, Brexit and the latest developments in Catalonia.

Click here to listen to the interview on Bloomberg

US markets closed the week in bullish mood with strong performances from the S&P 500, Nasdaq and Wall Street all signalling a sense of optimism after the week’s developments. Last week might end up being viewed as a turning point for US markets. After months of uncertainty, US President Donald Trump has announced his nomination to take over from Fed Chair Janet Yellen, will be Jerome Powell. This news was taken well by the markets as Mr Powell’s views have been fairly similar to those of Janet Yellen and that should give market’s a better ability to judge how he will guide interest rate decisions in the future. Previous negative comments from Mr Powell describing the “Volcker rule” as overly burdensome towards banks suggests he may well be a strong ally for President Trump in his attempts to cut red tape.

Normally, when central banks increase interest rates their currency strengthens. The fact that Sterling sold off following the Bank of England’s first rate rise in a decade is a reflection of how disappointed FX traders were with the accompanying comments from Mark Carney, the Governor of the BOE. FX futures markets are now pricing in the next interest rate rise not happening until September 2018. As I mentioned in my weekly Bloomberg interview last week, I was expecting a “One and Done” statement due to the threat of Brexit continuing to hang over the UK economy.

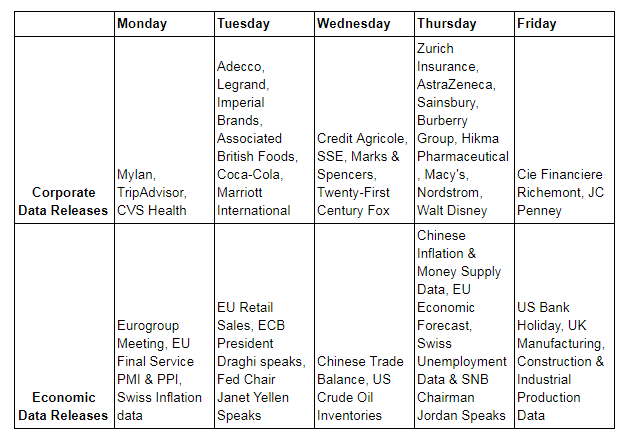

In the week ahead, we will be looking out for Wednesday’s Trade balance figures out of China. Now that we have a clear leadership structure and plan of action for the next 5 years in China, we will be expecting a continuation of the increase in consumption to be reflected in this data release.

On Thursday, we will turn our attention to matters closer to home as Swiss unemployment figures will be released. These figures do not often reflect anything that should worry investors but the speech from the Swiss National Bank’s Chairman Thomas Jordan in the evening might affect the strength of the Swiss Franc. Since last month’s high where EUR/CHF traded up to 1.1715, we have seen a little resilience in Swiss Franc strength, but not enough to break the upward trend. We are still expecting the EUR/CHF rate to break above 1.2000 in the months ahead, although not necessarily before the end of 2017.