Synopsis of the week

- As German election fever has finally come to a close, it is not until the exact structure of her coalition has been confirmed that Merkel’s victory will put lingering anxieties concerning the German markets to rest. The DAX rose an impressive 5.3% in September and remains just short of its highs for the year set back in June.

- The Trump administration has finally released initial plans on Tax restructuring in the US helping the S&P 500 set fresh all-time highs.

- The Dollar posted sharp losses on Thursday and Friday, as yields on 10 year U.S. Treasury bonds posted their biggest one-day gains since March, triggered by potential Tax reforms announced by the Trump administration.

Press Coverage

On Thursday evening Alastair McCaig Head of Investment Management for Fern Wealth joined Jonathan Ferro on Bloomberg radio discussing the 20th anniversary of the Bank of England’s independence, Brexit negotiations and the latest developments in the bond markets.

Click here to listen to the interview on Bloomberg

Monday will see the start of the fourth quarter and major equity markets have been heading higher over the last four or five weeks. Looking back over Q3, the DAX, FTSE and S&P500 all closed higher not before all three had struggled during August. In fact from their August lows, the DAX is up 7.5%, the FTSE up 2.58% and the S&P500 up 4.27%. A word of caution as far as the DAX is concerned as we saw a similarly impressive run in the CAC ahead of the French elections before much of that momentum has subsequently eroded.

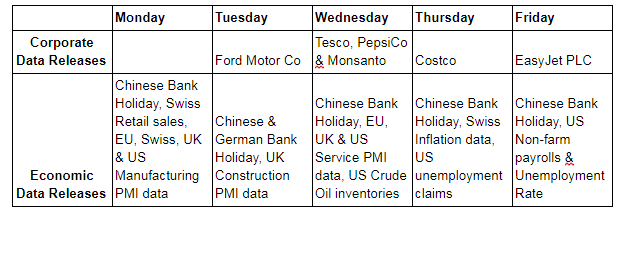

The PMI (Purchasing Managers’ Index), which serves as an indicator of economic health of manufacturing sectors will be released later this week by the US, UK, and EU. Expectations are the US & EU will remain strong while the UK will post softer figures.This data should provide more insight into the current business conditions for corporate decision makers, analysts and purchasing managers of raw materials and components. The strength of these figures and therefore optimism will subsequently be reflected in equity share prices.

The US Non-Farm Payroll data is due to be released this Friday. Stock markets pay particularly close attention to this as the data strips out seasonality changes and is correlated so quickly to the end of the previous month. Non-Farm payroll refers to any job, excluding self-employment, military and farm work. It is worth noting that August has historically been the worst month for Non-Farm Payroll data only producing an average of 69,000 additional jobs, however last month, the US economy created 156,000 jobs whilst September’s Payroll data being released later this week is expected at 96,000.

On Friday, stocks and equities in China finished mostly lower as the market closed ahead of a week full of festivities and holidays. Though banks will remain open for three days, it will be a full-week of closures on the Chinese mainland and Hong Kong and this will reduce trading volumes all through the Asian markets.