Synopsis of the week

- Equity markets had another torrid week closing lower although US markets did rally late on Friday (after Europe’s trading session stopped) closing the day out with the S&P 500 +1.5%, Dow Jones +1.4% and Nasdaq +1.7%.

- Regardless of current equity market volatility, Central banks spent last week confirming their interest rate rising policies, reflecting their confidence in the ongoing economic fundamentals.

- Switzerland stepped away from their normal neutrality as the women’s ice hockey team thrashed the unified North & South Korean team 8-0, dashing the hopes of those looking for a fairytale story at the PyeongChang winter olympics in South Korea.

Press coverage

On Wednesday evening, Fern Wealth Director of Investment Management Alastair McCaig joined Amanda Kayne on CNN Money Switzerland where they discussed the current market conditions following the VIX triggered sell-off, the German coalition government announcement and moves in the Bond markets.

Click here to watch the interview on CNN Money Switzerland.

Equity markets again struggled last week as the risk off mentality prevailed. The Fern Wealth investment management team have been closely monitoring these moves as the correction in equity indices developed over the week and will continue to update clients as market conditions dictate. The sell-off in equities was originally caused by a spike in the volatility index and technical levels being breached and automatic programmes reducing market exposure. Unless we see anything to the contrary, our opinion remains that this is a technical correction rather than a fundamental one. With technical corrections, we tend to see shorter, sharper and more aggressive moves. These moves have helped rebalance equity prices and realign fair value in many equities. The fundamentals of the global economies remain strong with central banks confirming their policies to raise interest rates gradually, equities continuing to post improving results and outlooks in this latest reporting season and economic data releases continuing to improve.

We need to go back to 2016 when the last fears of rising interest rates spooked the markets in the US. We have written before how the markets tend to overreact and this was a classic case with the S&P 500 falling 11% from December highs to February lows before ‘buy the dip’ mentally came in and the market continued to strengthen until the last week. In short readers, volatility is good as it allows the market to correct itself and fresh money to enter.

Back to last week, Friday is not historically a day when traders open fresh positions but normally a day when they look to reduce exposure ahead of the weekend. This Friday, however, we saw the Bulls move back into the market driving the three major US equity markets up in the afternoon session. When European markets open on Monday morning, they will look to play catch up with their US counterparts as most of these moves developed after European markets had closed for the week.

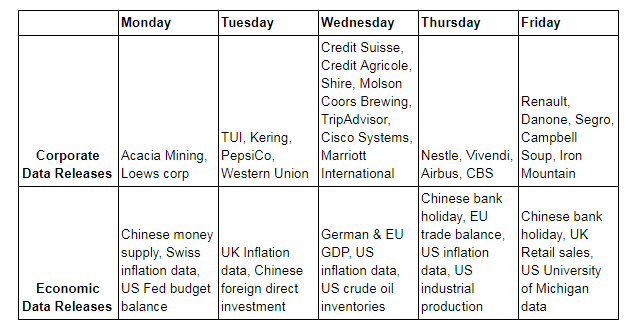

Corporate releases

In the run-up to and during the reporting season, companies are restricted on what share buy-back schemes they can operate as they enter a quiet period. Now that corporate data releases are coming to an end, we will be monitoring corporate statements as buying back shares has been highlighted as one of the areas companies would look at to utilise the increased capital from the new Trump Tax rules.

We will still have plenty of interest in the Swiss markets next week with Wednesday seeing Credit Suisse report its quarterly earnings followed on Thursday by Nestle. Nestle has a market capitalization of Chf 235 billion, which accounts for over 20% of the Swiss stock exchange overall weighting and its corporate release will dictate how the exchange performs next week.

Image by Gerd Altmann from Pixabay