Synopsis of the week

- The Bulls dominated last weeks trading as the “buy the dip” mentality took hold of the investment community, helping to drive equity markets higher.

- The US Dollar had another poor week, regardless of the economic data releases, increasing the chances of multiple rate rises over the remainder of 2018.

- Investors once again focused on the Economic and Corporate fundamentals while volatility fell, although not back to levels enjoyed through 2017.

A week is a long time in the markets and this time around, I am able to report a bounce in the S&P 500 of 4.3% after writing last week that the S&P 500 had fallen by 5.2%. In our last notes, we tried to convey a sense of calm that the correction we were seeing had been triggered for technical reasons and was not a fundamental change to the investment arena. We also noted that this was an ideal opportunity for fresh money to be invested in the markets. Last weeks move higher in equity markets was welcome but we are still a little way off levels we reached at the end of January and we may experience a little more volatility before we are able to see 2018 setting new highs again. Considering the performance in the first 4 days of the week and the fact that Monday is a bank holiday (Presidents Day) in the US, the profit taking seen on Friday was quite muted.

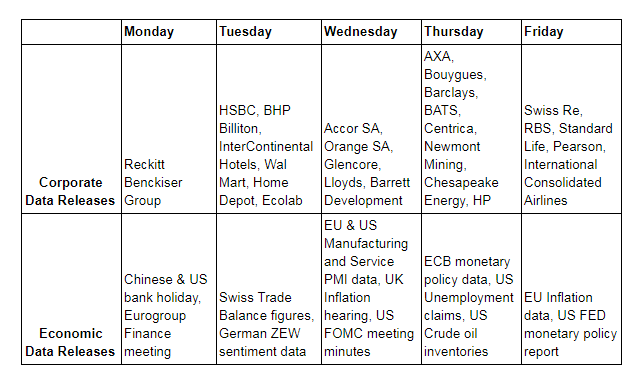

This week should see a quieter start as both China and the US enjoy a Monday Bank holiday. It will be interesting to see how markets perform in the absence of US traders as global investors have tended to follow the lead of their US counterparties.

The rest of the week will have plenty packed into it as we are getting inflation updates from the UK on Wednesday, along with important economic sector data releases covering the US and EU. Wednesday’s highlight will be the minutes from the FOMC in the evening as this was Janet Yellen’s last meeting as its chairperson. We will also be expecting statements from several members of this committee being delivered so we could hear mixed messages over the day. On Thursday, the ECB monetary policy committee will be posting its latest report while the US Fed will be posting their equivalent report only 24 hours later.

Corporate releases

Just over 400 of the S&P 500 companies have now reported their quarterly reports and so far, 75% of them have posted better than expected profits while 78% have posted better than expected sales figures. This impressive performance along with the recent sell-off seen in equity markets does help rebalance where these companies P/E (profits / earning) ratios lie and subsequently, how attractive they are to investors.

This week will see the bulk of the biggest names posting quarterly updates coming from the FTSE. The boost that many of these UK quoted companies enjoyed following the collapse in Sterling, post-Brexit, has continued to be reduced as the British Pound has gained strength against the struggling US Dollar.

Image by Gerd Altmann from Pixabay