Synopsis of the week

- Comments from politicians rather than economic data is once again driving the markets as worries over the tussle between the US and China over trade tariffs have knocked investor confidence.

- As expected, Fed Chairman Jerome Powell announced a 25 basis point interest rate rise in the US taking rates up to 1.75%.

- The major US equity markets closed the week down by 6% while the DAX fell by almost 5%.

Press coverage

On Wednesday evening, our Head of Investment Management, Alastair McCaig joined Bloomberg anchor Jonathan Ferro to discuss the US Fed’s interest rate decision, Deutsche Banks market update and Facebook issues with data breach and share price collapse.

Click here to Listen to the interview on Bloomberg.

Equity markets and Economic data are heading in opposite directions, this is a template that we have seen in place since the market correction at the beginning of February. At present, investor sentiment is being dictated by the confidence central banks have shown in continuing on a path towards rate normalization and reducing stimulus along with solid economic data releases.This is balanced against worries revolving around a US-inspired global trade war and broader policy uncertainties. In our opinion, the longer-term benefits of the former outweigh the shorter-term volatility of the latter.

As predicted, the Federal Reserve Chairman, Jerome Powell, increased US interest rates, however, the accompanying statement has seen expectations of a potential fourth interest rate rise during 2018 diminish. The currency markets did react to this with the US Dollar index dropping by almost 1% in the following 24 hours.

The Bank of England also announced its interest rate decision and as expected left rates unchanged. Sterling did strengthen after this event on Thursday as two of the nine-strong committee voted for the rate to rise and this increases the chances of another UK rate rise in the next twelve months.

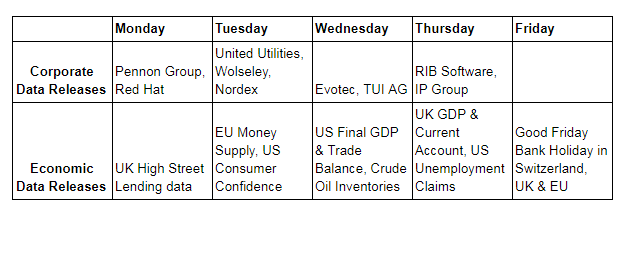

This week will be a short week ahead of a long weekend as Switzerland, the UK and the EU will be enjoying a bank holiday on Friday 30th March and Monday 1st April. Normally, we would expect a quiet week, however, that looks a little less likely.

We will be watching to see what further developments materialize involving trade tariffs. As the US President appears happy to conduct these discussions on social media rather than behind closed doors, we could see sustained volatility as a consequence. We are scheduled to see the latest US Trade Balance data on Wednesday and this could be the focus for the week ahead.

Image by Gino Crescoli from Pixabay