Synopsis of the week

- In total the ECB have purchased over €1 trillion of debt as they have remained firm in their efforts to stimulate the EU through Quantitative Easing. They currently have a mandate to purchase €80 billion of debt a month.

- ECB President Mario Draghi has not used this latest meeting to extend the current scheme beyond March 2017 but left the door open for that option at their December meeting. The biggest issue facing the ECB is that the pool of debt they could purchase is shrinking. They could be left with few options unless they alter their self imposed rules on what is acceptable debt.

- The Bank of England governor Mark Carney was again subjected to a barrage of questioning from the treasury select committee as they tried to pick apart the aftermath of the Brexit vote and the subsequent actions the Bank had taken. We also received confirmation that the Chancellor Philip Hammond will make his autumn statement on the 23rd November.

- Closer to home, we were proud to announce the launch of our new website which gives a clear overview of our wealth creation and asset management services as well as weekly insights into the financial news that matters most to expat investors.

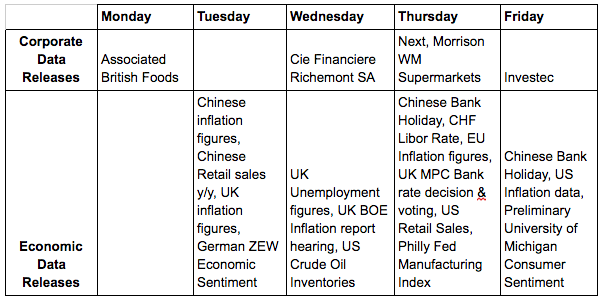

The Week Ahead

Economic Data

Last week it was the turn of the European Central Bank to update the markets on any interest rate changes or alterations to their stimulus packages. The President of the ECB Mario Draghi chose to keep his powder dry. This lack of change should not be taken as a sign that everything is working well, more of a realization that things could get worse. This coming week on “Super Thursday” it will be the turn of the Bank of England to announce any interest rate changes and more interestingly, who voted for those changes. At present the BOE looks the most likely of central banks to take action and this Thursday will let us know how close they are.

More broadly as far as central bank’s actions are concerned this does feel like the calm before the storm as most central bankers appear to be delaying taking any action until they feel things have become bad enough to warrant it.

It should be a quiet start to the week as a limited amount of important market moving economic data is due for release. Tuesday sees on overnight update from China as they release Industrial Production figures. We’ll then see the range of CPI and RPI inflation data out of the UK followed swiftly by German ZEW Economic Sentiment release.

The UK will again dominate economic data releases in the morning with the release of both the unemployment rate and average hourly earnings. With the wildly misleading comments we have seen from OPEC ministers over the last week or two the latest release of US Crude Oil Inventories could add even more volatility to oil prices.

Even though it’s a Bank holiday in China there will still be figures coming out over night along with unemployment updates from Australia. In the UK it will be “Super Thursday” while across the Atlantic we see retail sales figures, unemployment claims and Philly Fed Manufacturing data.

Friday is another Chinese bank holiday helping to ensure calmer overnight Asian markets while in the afternoon we will see another batch of US inflation figures.

Corporate releases

Corporate data releases this week are very thin on the ground this week although, those that are reporting are important ones. The market sentiment that can be obtained from Associated British Foods, Next and WM Morrisons will give an incite into the UK consumer’s shopping appetite.

Next, the UK clothing retailer, have for a long time been at the forefront of online clothing outlets and the release of their half yearly figures will give market watchers a good insight into the ongoing shift in consumer shopping habits and the migration away from high street to online.

In contrast the poorest relation in the big four food retailers in the UK, WM Morrisons will be first up to post half yearly figures. These figures will offer even more relevance when Kantor update the breakdown of market share.