Synopsis of the week

- European traders prepare for Italian referendum disappointment and increased instability.

- European equity markets start December with a whimper, not a bang.

- The China 300 recovery is almost complete eleven months after regulatory intervention triggered its collapse.

- OPEC agree on a deal. (reliant on Non-OPEC nations agree to action too at their meeting next weekend).

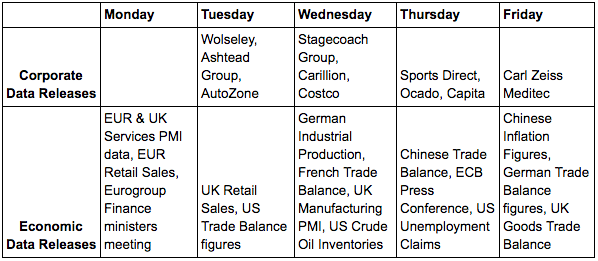

The Week Ahead

Economic Data

The last barrier to the US Federal Reserve raising interest rates was, on Friday, cleared with Non-Farm payrolls coming in as expected. In all honesty, we would have had to see some truly awful numbers to have dented the almost fully factored chances of change.

Italian politics now find themselves at the centre of global attention as Sundays referendum election results could well be the trigger for a swift Italian general election. The results themselves are not necessarily the issue but they could be the beginning of a dominoes effect of increased instability in the EU region and in a worst case scenario the catalyst for the end of the euro. Italian political instability is nothing new but it will be interesting to see how quickly the markets discount events.

Although European markets have struggled it is worth noting that the China 300 is now down 2.5% on the year an impressive turn of events considering the index was down by over 25% earlier in the year. At this point in time last year we were all worried about a collapsing Chinese economy but in comparison to other economic regions it has been one of the calmer investment environments.

OPEC have managed to come to an agreement by the end of their meeting however Oil output reductions will only be ratified if Non-OPEC nations also agree to reduce production in their own meeting a week later. The annual meetings for OPEC oil ministers in Vienna has had a very formulated template for the last number of years and I am finding it difficult not to have a cynical opinion of these latest events especially as a number of the OPEC nations have decided to cut weeks after posting record monthly production levels.

Corporate releases

Tuesday sees Ashtead, a company we have previously bought after their second quarter figures give their latest update to the market. The company’s shares are now overbought having benefited from both the weakness in Sterling and the perceived increased spending from a Trump led US infrastructure spend. This might trigger some profit taking so we will be closely monitoring the stock for any trading opportunities. Ocado the food retailer and distributor will also be reporting next week but the company’s fourth quarter data might not make for pleasant reading. A combination of squeezed margins dropping market share and rising underlying costs all point towards data releases that will disappoint an already sceptical investor pool.