Synopsis of the week

- US equity indexes head higher as expectations that the Dow will hit 20,000 before the end of the year grow.

- The European Central Bank decide to extend quantitative easing from March until December 2017 but reduce the monthly spending from €80Bn down to €60Bn.

- FX Markets look ahead to an almost fully factored in December interest rate rise in the US.

- European markets shrug off Italian referendum results before Monday’s trading day has finished.

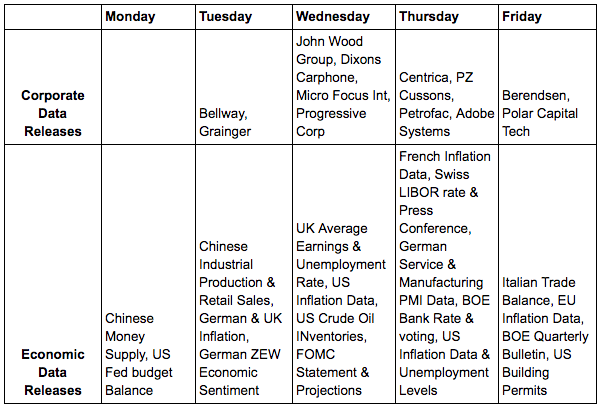

The Week Ahead

Economic Data

In last week’s note, ahead of the Italian referendum results we said:

“Italian political instability is nothing new but it will be interesting to see how quickly the markets discount events.“

The answer was in less than a day’s trading. Investors and traders alike will have noticed the speed with which equity markets are discounting the negatives of major events. Looking at how quickly the FTSE bounced off its Brexit lows, the recovery of the US equity markets from Donald Trump’s success and now the bounce of European equity markets having previously been worried about the destabilising effects of the Italian referendum. This begs the question, how bad does the news have to be to have a long lasting effect?

On Thursday, the European Central Bank took markets by surprise by altering their Quantitative easing plans. The previous scheme was due to expire in March 2017 but markets had assumed that change would happen closer to the deadline and that this would merely see the deadline rolled forward. However, Mario Draghi has decided to preemptively change the template. The extension to December is no surprise but the reduction in monthly bond acquisitions from €80Bn down to €60Bn was. This coupled with the looming interest rate rise in the US has seen the EUR/USD exchange rate drift back down towards the long-term support of $1.05 and after numerous tests over the last couple of years this might well be the environment when we finally see parity between the Euro and the US Dollar.

We are now approaching the time of year when we historically see the beneficial effects of a “Santa Rally” in equity markets. This year however, we have already seen strong runs in numerous equity markets and we would be starting from already elevated levels. How much more upside can be added to these current values is going to be difficult to gauge but investor appetite does not look to be fully quenched yet.

Corporate releases

Once again this week will see limited corporate data releases, as December is never a popular month to update the markets but one or two big names are on the schedule. We will also be keeping an eye out to see if any company tries to sneak out bad news when investors focus is not fully focused.

(Photo by Ivon Gorgonio from Pexels)