Synopsis of the week

- Friday saw US unemployment remain unchanged at 4.9%, average hourly earnings increase by just 0.1% and Non farm payrolls increase by 151,000. All three worse than expected. Independently they are not enough to send alarm bells ringing with the Fed but it has surely ended any chance that rates will rise after the September meeting.

- Last week Chinese manufacturing figures once again grew following twelve months of stagnation. Equivalent manufacturing data from around Europe was less convincing with only the UK and Germany forging ahead.

- After two weeks of falls the FTSE , DAX & CAC all managed to have a positive week, but none were able to break to far away from recent highs.

- Monday’s US Labour Day bank holiday offers traders a quiet start to the week.

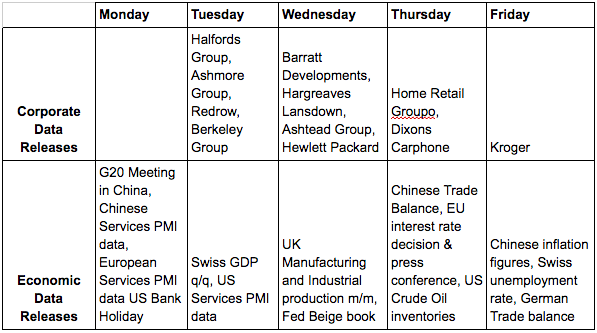

The Week Ahead

Economic Data

The latest G20 meeting starting In China comes to a conclusion on Monday. As always these events give politicians a global platform to make headline grabbing statements. Although these are not always the most helpful when it comes to market stability, market watchers will be waiting to see what new initiatives are agreed upon. Due to the large number of members having to all agree, expectations of large sweeping changes are normally low.

Monday will be a day of Services PMI data releases starting in China and then numerous European countries. With the service sector making up the lion’s share of the UK’s GDP FTSE traders will pay particular attention to the mid-morning release. As the US enjoys a bank holiday on Monday it’s likely that the afternoon session will turn into a clock watching event as the City will use this as an excuse to leave sharpish.

Unless Australia surprises the markets by announcing a change to their interest rates it’s unlikely that Swiss quarterly GDP will be enough to kick start enthusiasm for the morning session. The release of US Service PMI data in the afternoon will give Fed interest rate watchers something fresh to debate.

French President Francois Hollande has again publicly stated that UK Prime minister Theresa May should action article 50 imminently. Considering he holds the unenviable title of the least popular French President in history we suspect that she’ll be using Wednesday’s Manufacturing and Industrial production data as more of a catalyst to her triggering article 50.

Asian data releases from Japan, China and Australia over-night should ensure a lively start to Thursday’s trading. European traders will be on edge as they wait for the latest ECB interest rate decision, although no change is expected. Volatility however normally picks up 45 minutes later when ECB President Mario Draghi holds his press conference. An event that has the press trying to eek out more of an idea of what lies ahead during the Q & A session.

Over in the US we will also get the latest unemployment data along with Crude Oil inventories.

In contrast Friday’s excitement will be almost over before it starts as the latest Chinese inflation figures will be released before European traders are even at their desks.

Corporate releases

Once again the British Olympic team have done their best to set Halfords up for a profitable half yearly release by coming back from Rio with a plane full of cycling medals.

The UK housing market was always going to be one of the sectors most affected by the Brexit vote so this week’s releases from Redrow, Berkeley Group and Barratt Development will give a clearer picture of how badly sentiment to the housing market has been dented.

UK quoted construction equipment leasing firm Ashtead are set to post their first quarter figures on Wednesday. This firm derives the majority of its revenue from the US and has benefited both from the strong demand inside the US but also the weakening of Sterling against the US Dollar and these latest figures look set to continue a trend of keeping investors and shareholders happy.