FERN WEALTH SEMINAR

Last week’s seminar at Fern Wealth’s offices was a particularly successful evening with a full turn out on the night. Providing clients and prospective clients an opportunity to mingle before the event. Topics of interest in the Q&A session that followed the seminar included

- Fern Wealth’s opinions on the future weakness in the Swiss Franc

- The flexibility and transparency of the investing in funds through Moventum Asset Management via Fern Wealth

- Shifting investor sentiment from the US to Europe

Attendees said it was “A very inspiring and valuable seminar’

Feedback on what they found most useful from the seminar was:

- “Discussion on currency shifts & market volatility”

- “The consequences and challenges for expats in their financial planning”

- “The alternative to traditional fund management provided by Fern Wealth”

- “The overview and insight into how funds work”

- “Absolute transparency in costs compared to Swiss Banks”

Synopsis of the week

- With less than two weeks to go until the UK general election on the 8th June, Sterling strength has eased off over the week.

- While the US President has been out of the country the Dow and the S&P 500 have spent the week climbing higher.

- The markets look ahead to the last Non-Farm payrolls before Fed’s June interest rate decision.

- The debt rating agency Moody’s downgraded Chinese debt for the first time in almost 30 years.

Press Coverage

Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s Jonathan Ferro for his weekly half hour show where they discussed sterling, the latest comments from the European Central Bank and rumours surrounding the Bank of England Governor Mark Carney.

Click here to listen to the interview on Bloomberg

The Week Ahead

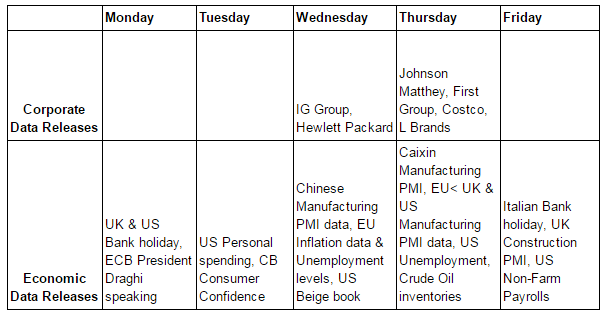

Economic Data

US President Donald Trump has spent the week out of the US on a mini-world tour, during this time US equity markets have had a resilient week. Is this correlation or a coincidence? His absence has offered investors a respite from the negative press that had been denting any optimism Wall Street might have been generating. The last leg of this mini tour is the 43rd G7 meeting being held in Italy. Topics of trade protectionism and climate change are subjects that the US President and the majority of the other leaders have widely differing opinions on.

Both the US and the UK will be enjoying a bank holiday on Monday. This short week will be reflected in the corporate data due for releases.

We are still due to see the latest US Non-Farm payroll data on Friday and this will be the last set of these figures before the Fed’s interest rate decision on 13/14th June. FX futures markets are still strongly factoring in a rate rise so only a truly awful set of data out will change this sentiment. Expectations are for a further 186,000 jobs to be created over the month falling below last months 211,000.

Sterling has weakened over last week as the Conservatives lead over the Labour party has been cut back. Hopes of a strong Conservative victory and the clarity a strong majority win would have created is looking less certain with under two weeks until the 8th June vote.

The financial crisis in 2008 saw the reputations of the debt rating agencies badly dented and subsequently, their opinions carry a little less weight than they used to. Moody’s have for the first time in almost 30 years downgraded Chinese debt but this hardly caused any discussion on trading floors. The market’s reaction has been muted but we will watch to see what further ramifications might materialise in the perceived values of investing in the Asian markets.

Corporate Releases

Due to the short week, any moves in the equity markets are almost certainly going to be driven by political or economic data.

Photo by Stijn Kleerebezem on Unsplash