Synopsis of the week

- European equity markets continued moving sideways as traders waited for the ECB president`s comments regarding the EU’s QE scheme during his speech in America at the end of the week.

- Until Tuesday mornings North Korean missile test the panic caused by statements from both North Korea and the US appeared to have eased. Gold’s spike to $1,325 is a clear reflection that worries still persist or even escalate.

- The UK continues to surprise with its economic data releases as last week’s unemployment levels of 4.4% were the lowest seen in 15 years. Where this resilience is coming from is hard to pinpoint as Brexit negotiations with the EU remain painfully slow.

- The last week in August should signal a return to more normalised equity trading volumes around the world. Will this see an improvement to the lackluster performance of many of the major equity indices?

Press Coverage

On Tuesday evening Alastair McCaig, Director of Investment Management at Fern Wealth, joined Bloomberg anchor Jonathan Ferro for an hour long show. Topics discussed included the bounce in the FTSE over the day and individual movers, Britain’s first July Budget surplus since 2002 and the appetite for US Bonds with over $1 Trillion having been issued this year already.

Click here to listen to the interview on Bloomberg

The Week Ahead

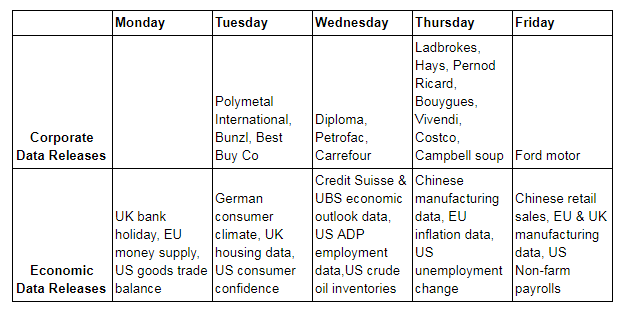

Economic Data

The next few weeks should see a considerable amount of time being spent analysing the “US Debt Ceiling”. Currently, the US has a mandate for just short of $20 Trillion of debt and as the country continues to spend more than it generates, this limit periodically needs to be reviewed and subsequently raised. As the US house and the senate are both run by the Republican party it had been hoped the unified political stance behind their President would see the wheels of democracy turn a little faster. That misconception has certainly been crushed and we would expect disagreement and squabbling to remain prevalent all the way to the eleventh hour. Debt rating agencies have already started highlighting the risk to the US’s AAA status should they default. Most market observers expect this to ultimately be resolved but not before the uncertainty dents enthusiasm for both US equities and the US dollar.

The two biggest take away points from the latest Jackson Hole Central Bank symposium are firstly; Fed Chair Janet Yellen does not appear to be too bothered about extending her seat at the helm of the Fed past her current term which ends next year. Changes at the top of the Fed shouldn`t be too much of a surprise, especially as US President Donald Trump has never been her biggest fan. Secondly, Mario Draghi, the ECB President avoided making any leading comments about the current EU QE scheme. The aftermath of this saw EURUSD spike higher, hitting levels last seen in January 2015. Since the original announcement of the QE scheme at the Jackson Hole symposium in 2014, the EU has purchased some €2 Trillion of debt and although that will come to an end, they are not in a rush to wind it down just yet. It would appear a slow and steady reduction in this process looks set to be the template.

Over the last eight weeks, we have seen the EUR/CHF move from 1.0850 up to 1.1500 before pulling back to just below 1.1300 In part, this sell off was due to the speed with which the Swiss Franc had depreciated against the Euro. The other catalyst for the retracement in the exchange rate was the flight to the safe haven of the Swiss Franc. With worrying comments from both the US and North Korea, monies began to move into safe haven destinations and Tuesday mornings missile test has seen this move strengthen. Historically, the Swiss Franc and Gold have always proven to be attractive destinations in these instances. We are still of the opinion that the Swiss Franc is overvalued and that a longer term move back towards the EUR/CHF 1.2000 level will develop, but these most recent developments in Asia could well slow down the speed of this.

Corporate Releases

The two noteworthy releases are Hay’s update to the market which will give a snapshot of how the employment markets around Europe are doing. While the latest sales data from Ford will give investors an idea of the appetite for big purchase goods around the world.