Synopsis of the week

- Asian & European markets start the week with a risk off mentality as traders try to gauge the increased risk following North Korea’s nuclear test at the weekend.

- Monday’s Labour day bank holiday in America will give US traders more time to digest these recent developments as they head back into the office on Tuesday.

- EU & UK Brexit negotiations could see an increase in acrimony as the EU’s suggestion that the UK will have to settle £100Bn of debts comes in at £50Bn above the UK’s estimates.

- On Thursday the ECB will be announcing their latest interest rate decision followed by a press conference. Markets will want to hear when the ECB will taper the current QE scheme.

Press Coverage

On Wednesday evening Alastair McCaig, Director of Investment Management at Fern Wealth, joined Bloomberg anchor Jonathan Ferro. Topics discussed included the lack of developments in Brexit negotiations, Eurozone economic data releases and how strong the US economy looks as the US debt ceiling debate increases.

Click here to listen to the interview on Bloomberg

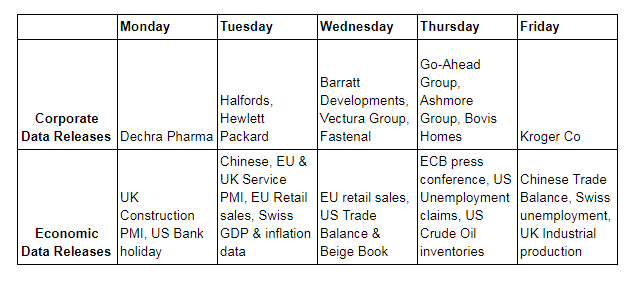

The Week Ahead

Economic Data

Events in North Korea over the weekend will dominate trading floor discussions in the early part of the week as traders and investors will try to analyse what further events might materialise. As the US will be enjoying a Labour Day bank holiday, markets will be shut on Monday and this extended weekend could see a calmer market reaction. The West and specifically Donald Trump find themselves in a difficult situation as tough talk from the US has already been ignored by North Korea. As long as China continues to export oil and other goods to North Korea, the effects of any UN sanctions against them will be diminished. This is a very complicated situation as both China and Russia do not want an irritated nuclear power on their doorstep, nor do they want to encourage the US to increase their military presence in the region.

As the US media’s attention is focussed on events in Asia, the Trump administration should look to utilise the lack of scrutiny and make progress on getting the US debt ceiling increased. Events in Texas over the last week will see the need for funds from the budget to help the region and this should help the Trump administration push through changes.

Thursday will see the long awaited ECB press conference announcing interest rate decisions. The market has factored in no change in rates, however the accompanying press conference will give ECB President Mario Draghi the stage to discuss future plans for the current QE scheme. The tail end of last week saw a number of EU sources suggesting that the EU was not ready to end this scheme and the current monthly €60 billion would be maintained with an extension to the deadline announced. Judging by how solid the Euro has remained throughout the turbulent last couple of weeks, this is certainly the view held by the FX markets.

German elections are now less than four weeks away and the strength of the Euro will be a worry for their export driven economy. Angela Merkel still looks the most likely leader of any coalition government that Germany can form and should she regain leadership, it is likely to underline the perceived strength of the Euro and the EU.

Monday will see the return of UK Parliament and a renewed focus on Brexit. Last week saw the EU announce that the UK’s total financial commitment to the EU might be as much as £100 Billion. This is some way off the £50 Billion the UK has calculated.

Corporate Releases

This week will see the release of UK House building figures from both Barratt Developments and Bovis Homes. The weak Pound has helped make UK property prices appear cheaper to foreign investors. In contrast, the ongoing uncertainty over Brexit will have dissuaded some from investing in the UK until the outlook is clearer. Due to the proportionally high number of property owners in the UK and the consequences of interest rate rises to those mortgage payers, it will ensure it is not just equity investors who watch this data carefully.