Synopsis of the week

- Although not clear yet what will happen the word impeachment is increasingly being seen in headlines about US President Donald Trump.

- Equity markets around the world fell away over the first half of the week only to stage a partial recovery during Thursday and Friday’s trading sessions.

- Swiss National Bank President Thomas Jordan confirms his preparedness to take action on the Swiss Franc.

- Theresa May talks tough saying no deal with EU is better than a bad one.

Press Coverage

Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s Jonathan Ferro for a half hour show where they discussed the market’s reaction to the latest issues surrounding the Trump administration, the strength in EUR/USD and the sell-off in equity markets

Click here to listen to the interview on Bloomberg

Our Director of Investment Management Alastair McCaig comments on Dukascopy TV. Discussing the market’s reaction to the latest Trump administration issues the ECB’s current thinking and how the UK elections will affect the strength of the Pound against the US Dollar.

https://www.youtube.com/watch?v=5ftKSip9-1E

Fern Wealth Seminar

Following on from the success of our first seminar we are pleased to announce that we are inviting clients and prospects along to our offices for an informal evening of conversation and discussion on Tuesday 23rd May. Fern Wealth directors Steven Flintham and Alastair McCaig will be looking at “Why everyone should be investing in funds and how to get started” for further details and an opportunity to reserve your place please go to our seminar landing page here.

Limited spaces left

The Week Ahead

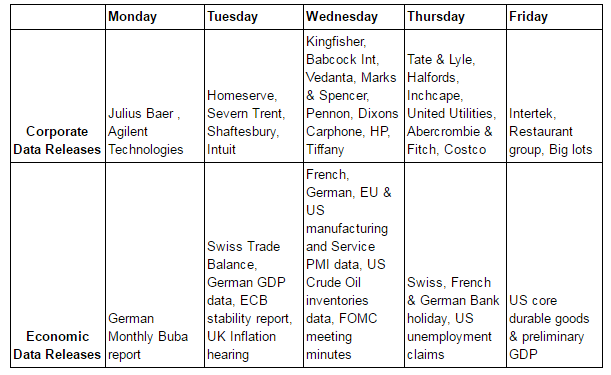

Economic Data

Over the next eight days Donald Trump will be visiting five countries and included in the tour will be Saudi Arabia, Israel and the Vatican city. That is an itinerary that will offer plenty of opportunities for the US President to get into even more bother, but considering the pressure he was facing in the US over calls for him to be impeached this might actually be the lesser of two evils. As far as investors are concerned all of this just adds to further delays to what they would really like the Trump administration to be doing.

This week saw Thomas Flury UBS’s senior currency strategist call for the EUR/CHF exchange rate to reach 1.1400 in the next six months while his expectation for the next twelve months was for it to reach 1.1600 In little over a month we have seen EUR/CHF already climb by 2.25% and his call we see levels last hit in February 2016 initially and then on to the 1.1600 a level not seen since January 2015 when the Swiss National Bank removed its peg. These are big calls indeed. This was also the week Swiss National Bank President Thomas Jordan made the following statement to Italian press “The Franc is still overvalued, which is why negative interest rates and our readiness to intervene in the forex market remain necessary”.

Thursday will see OPEC members once again meeting in Vienna to discuss global production levels. US light Crude is up over 10% from its early May lows and will need some strong words of encouragement from this meeting to maintain these levels.

Corporate Releases

Last week’s surprisingly strong UK retail sales figures might be an indication of what we can expect this week from the likes of Kingfisher, Marks & Spencers, Dixons and Halfords. Regardless of all the political issues surrounding the UK and Europe retail shoppers have continued to spend what they have in their pockets.

Photo by Ross Parmly on Unsplash