Synopsis of the week

- The Financial world looks to have implemented the harsh lessons that they learnt following the Brexit result earlier in the year with an aggressive “risk off” mindset dominating traders thinking ahead of this week’s US Presidential election results.

- Central Banks resist the temptation to change, ahead of a momentous week leaving December the month when gifts are most likely to be bestowed on traders.

- The Dow Jones collapses back to levels last seen 5 months ago as jitters turn to full on fear of the unknown.

- Capital preservation rather than appreciation will be the name of the game this week.

The Week Ahead

Economic Data

Normally I would use this section to update you on how the markets had behaved over the last week while digesting the relevant economic data releases, then turn my attention to what would be announced in the following seven days. But with the US voting on Tuesday and results due out in the early hours of Wednesday, Equity, Commodity and FX markets will all be poised, their attention on the latest polls. US elections are always binary events with one of only two outcomes, however in all the races that I have witnessed never has the divergence of opinion and direction of the nation been so extreme.

Should The Democratic nominee Hillary Clinton succeed, then the status quo would be maintained and equity and FX markets would both have a huge sigh of relief. If on the other hand, Republican Nominee Donald Trump wins then we can expect uncertainty and wild speculation to skyrocket.

Corporate releases

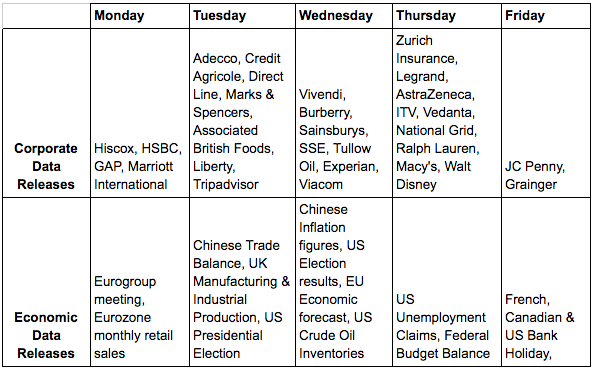

This week will see some big names releasing figures, HSBC the last of the big UK banks and Marriott International, fresh from their $13.6 billion acquisition of Starwood Hotels announce third quarter figures on Monday.

Although the likes of Adecco, Credit Agricole, Marks & Spencers, Burberry, AstraZeneca all announce figures over Tuesday, Wednesday and Thursday it’s hard to image they will manage to claim much of the market’s attention. Friday will see bank holidays in France, Canada and the US ensuring this is not going to be a great week as far as corporate data is concerned. Having overseen many turbulent events while working in the city the cynic in me will be watching out for the odd company trying to sneak out awful news/figures under the cover of the US elections.