Synopsis of the week

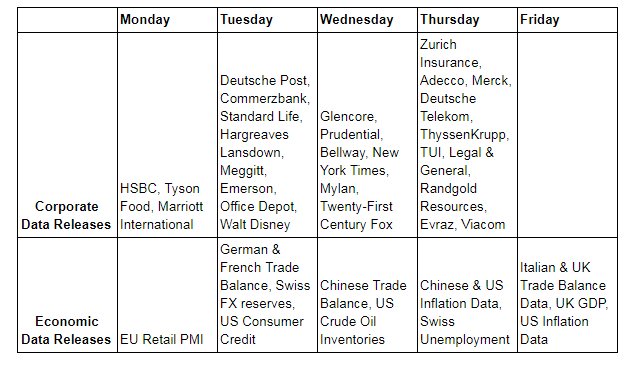

- A big week for US corporate data saw almost a third of S&P 500 companies reporting quarterly figures and maintain the positive mood.

- During the week, Apple became the first company to see its market capitalization hit $1 Trillion as its shares traded above $208 during the week.

- US President Donald Trump has announced he is winning the trade war with China. This coincides with the Japanese stock market being valued at higher levels than its Chinese counterparts for the first time in four years.

Press coverage

On Wednesday evening, Alastair McCaig, our Head of Investment Management joined Bloomberg anchor Jonathan Ferro and Richard Jones, FX & Rates Strategist. In this week’s show, they discussed the Bank of England’s expected rate rise and the expected path of future changes. They also discussed the US President’s trade war with China and the possibility of tariffs being increased.

Click here to listen to the interview on Bloomberg

Last week saw the Bank of England raise interest rates to 0.75%, its first real step towards rate normalisation since Governor Mark Carney took the helm. This move had been fully factored in by the FX markets and in the 24 hours that followed, Sterling weakened against all other major currencies. The Bank of England governor, Mark Carney, broke with his normally impartial stance by outlining the potential negative impact of the current Brexit discussions and lack of progress. At the moment, the FX markets are pricing in the next rate hike for September 2019, a full year away. The reason for this move is probably down to two key drivers. Firstly, the economic data is allowing them to do so, employment levels are at record highs and inflation is above the targeted 2%. The second reason being that while they are able to, they need to raise rates in order to cut rates when the next downturn happens.

Last week, saw just over 30% of the S&P 500 companies post quarterly figures. In total, we have now seen 80% of companies posting quarterly data and of those, 81% have managed to make earnings statements at levels better than expected. US corporate profits are up 24% in this season and the average sales figures continue to show an improvement of 10%. On Friday, the US announced unemployment levels had fallen to a record low of 3.9% and that average hourly earnings continued to improve; both of these have helped drive retail consumer spending.

In contrast to the US equity markets, we saw the Chinese exchange fall in value below the Japanese equity markets for the first time in four years. From the highs seen in the Chinese exchange in January, the market has now lost 27% of its value, some $2.3 Trillion. This devaluation is obviously far greater than the financial cost of trade tariffs that have been mentioned so far by US President Donald Trump but it does demonstrate how much worse the investment markets think the situation will get before the two countries are able to find a resolution.