Synopsis of the week

- We are still some way off the final results of a French election but this week has increased fears of a lame duck government or even a far right victory. French voters look just as dissatisfied with the current government as American voters were only a few months ago.

- Greece has come back into focus again as deadlines for debt repayments loom. Although not quite at tipping point the balance between stimulus and austerity has still not been found.

- The rally in the Gold price has continued to tick on quietly in the background. The spot price is now comfortably above the 100-day moving average and now only $25 away from its 200 day moving average. If this level were to be broken it could be the trigger for momentum traders to move into action.

- No list of important events is now complete without mentioning Donald Trump. This weeks comments around changing US tax laws gave the markets a shot in the arm. This flurry of excitement was based around a tweet and considerably more information is required to make these moves more sustainable.

The Week Ahead

Economic Data

Following last week’s tweet teaser from Trump, the markets will be looking out for any sign of clarification as to what the new US administration will do about shaking up the current tax rules. So far Donald Trump has stuck to his pre-election promises (by and large) and the markets will be hoping that a more accommodative corporate tax structure can come into play.

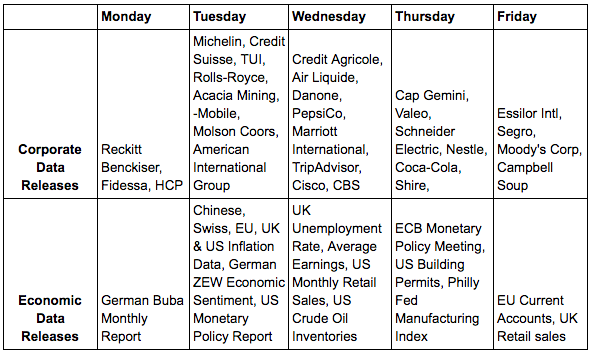

The economic data releases only starts to get interesting from Tuesday onwards as we will get a feel for the inflationary pressure coming out of China, Switzerland, the EU, UK & US. Coming out on Tuesday morning will also be the latest German corporate confidence figures in the form of ZEW data releases.

Wednesday will see US retail sales data that should not be too surprising, considering we have had the majority of US quarterly releases over the last couple of weeks. As ever the weekly US Oil inventories could give Crude Oil a nudge depending on consumption.

Europe should be the focus on Thursday and Friday as firstly we have the ECB monetary policy meeting and secondly the EU current accounts. Although not designated as a specific topic of discussion it will not be too surprising if we see Greece once again being one of the major topics of discussion.

Corporate Releases

Financial firms should be feeling a little more optimistic with their outlook as the shift in central banking phraseology and increase in inflationary pressures hints towards the cycle for interest rates once again increasing. Higher interest rates should improve profit margins for the likes of Credit Suisse, American International Group and Credit Agricole.

Marriott International should have plenty of interesting comments too what with its multi billion merger with Starwood hotels still being completed and the implications to global business trips dented by a less friendly global trade environment.Switzerland will have one of its busiest weeks with Credit Suisse and Nestle both reporting, any comments about the strength of the Swiss Franc will also be closely watched as EU stability looks a little shaky and Gold once again shows signs of coming back into demand.

Switzerland will have one of its busiest weeks with Credit Suisse and Nestle both reporting, any comments about the strength of the Swiss Franc will also be closely watched as EU stability looks a little shaky and Gold once again shows signs of coming back into demand.