Synopsis of the week

- The delivery of a white paper on Brexit by Theresa May might well have been 77-pages long but did little to answer any of the complex questions the investment community wanted clarity on.

- The FOMC statement on Wednesday evening rather underwhelmed the FX markets as it gave little reason to expect the next US rate rise to be imminent. Although not altering expectations that we will see two before the end of the year it has seen some of the US Dollars strength eroded.

- Much like his American counterpart, the Bank of England governor Mark Carney downplayed inflation expectations as he discussed the latest inflation report.

- Friday’s US jobs data, Non-Farm payroll figures came in much stronger than expected continuing the trend of Trump friendly economic data releases in his first few weeks in the White House.

The Week Ahead

Economic Data

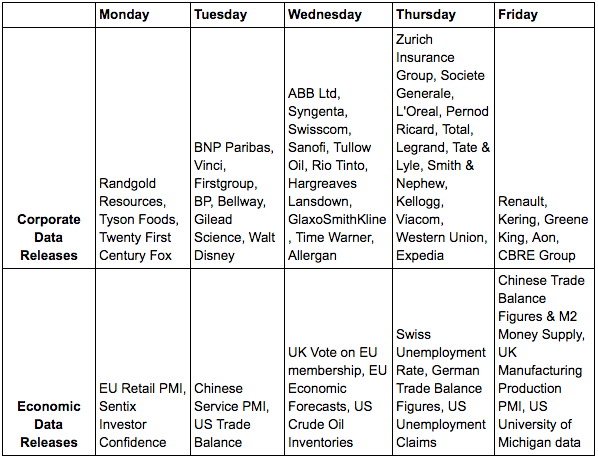

The start of the week will see little in the way of economic data releases. Tuesday’s Chinese Services PMI data and US Trade Balance figures being the only two highlights worth noting.

Europe will be the main focus of the day on Wednesday as the UK parliament votes on its EU membership. Although many members of parliament have openly talked of their disapproval of the public’s Brexit vote the conservative leader Theresa May has continued to talk confidently about the result. On the same day, we will also hear from the EU who will be announcing their economic forecasts.

On Thursday we will see the latest German trade balance figures which will give impetus to the Euro especially as we have witnessed increased interest in global trade with the arrival of Trump.

It will be China’s turn to announce trade balance figures on Friday along with a snapshot of the UK manufacturing sector later in the day.

Corporate Releases

An indication of global demand for commodities will be given with both Randgold Resources and Rio Tinto posting quarterly updates. Both companies continue to enjoy a revenue stream based in US Dollars while reporting in Sterling.

On a similar theme BP, Tullow Oil and Total will show how oil companies are finding conditions. The continued strength of the US Dollar over the last quarter will certainly be a bonus however the ever shifting claims of OPEC nations regarding their future production levels have ensured oil prices have remained volatile.

With no presidential tweets about drug prices for a while Gilead Science, GlaxoSmithKline and Allergan will be a little more optimistic about how the markets receive their quarterly data.

Away from Oil, Drug and Commodity sectors, we will also hear from big names such as BNP Paribas, Walt Disney, Swisscom, ABB, Zurich Insurance Group, L’Oreal, Viacom and Renault.