* Actually, 19999.63 was the high, but as we’re amongst friends we decided to round up!

Synopsis of the week

- The FTSE looks to have started 2017 off in the same fashion it finished 2016 as it continues to edge higher.

- European retailers suffer as UK heavyweight Next collapses with awful year-end sales figures.

- Donald Trump continues to use twitter as his favourite platform to announce potential policy decisions.

- OPEC members have begun cutting production levels as promised in November and trigger a 28% increase in US light since then.

The Week Ahead

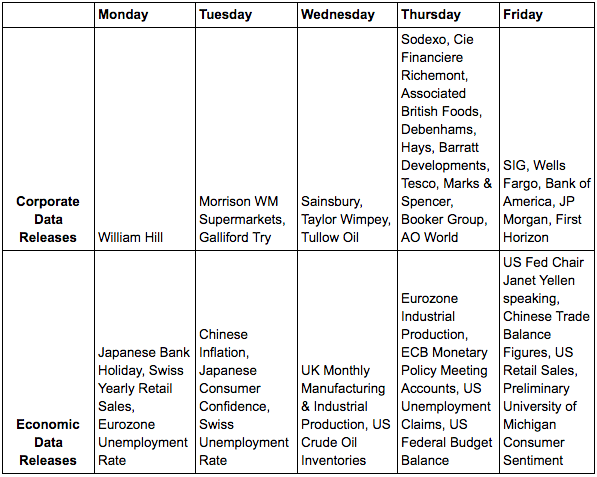

Economic Data

The last monthly non-farm payroll figures of 2016 for the US economy were posted on Friday with the headline figure lower than expected. However, the underlying strength in sentiment was highlighted with a strong increase in average hourly earnings which enabled the DJ30 to finally hit an all time high of 20000. Further, these figures back up the market’s expectations that we’ll see another two or three interest rate rises in the US during 2017.

Europe’s major equity markets have continued where they left off at the end of last year and look strong. The FTSE, with its greater exposure to US dollar revenues, has for the first time, broken above 7200. As yet the worries about political uncertainty have yet to manifest themselves in outright weakness, but this will be something we will keep a close eye on.

On January 20th, Donald Trump will be inaugurated in the US. His fondness for announcing potential policies on his twitter account is sure to be a hotly discussed topic. Having only 140 characters at his disposal will see investors frequently having to jump to conclusions with limited facts available. The markets wait with baited breath for further “announcements”.

OPEC appear to have implemented a New Year’s resolution already as numerous members have actually put in place measures to reduce their oil output levels. How long this new found unity holds will be interesting to watch, especially as oil prices rise and governments become increasingly tempted to capitalise on higher oil prices and improve revenues. For the time being oil prices remain strong.

Corporate releases

This week will see a combination of UK food retailers and house builders reporting their figures. Both these sectors have felt the effects of the Brexit vote as both inflation and perceived interest rate movements have altered profit margins. Good news could be thin on the ground for both.

Across the Atlantic, we will be getting figures out of the US banking sector which should be in complete contrast. As US interest rates have increased and look set to head higher, profit margins for US based banks will improve and this should already start to be reflected in these fourth quarter figures.

We at Fern Wealth wish you all a successful 2017.