Synopsis of the week

- It was a week of jitters as traders and investors alike tried to rebalance market exposure ahead of Donald Trump’s inauguration.

- The first half of the week was dominated by Theresa May’s speech on what she would be looking to achieve from March’s negotiations following the triggering of article 50.

- This year’s Davos WEF meeting completely ignored what has gone on in years past. Chinese President Xi Jinping striking a particularly supportive note for globalisation somewhat in contrast to many of the west’s leaders.

- After the previous couple of weeks which had seen numerous record highs being set, European and US equity markets have spent most of the week giving back those gains.

The Week Ahead

Economic Data

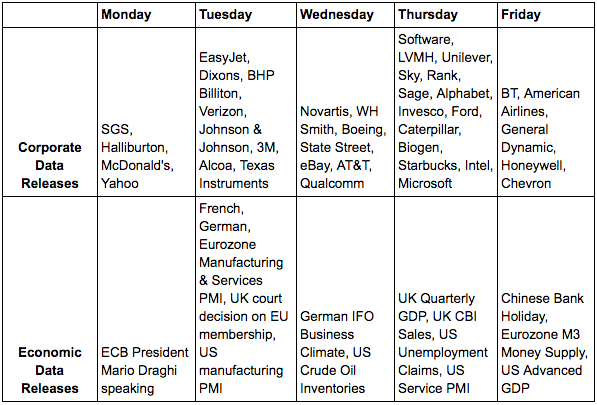

Normally in this section I talk about what economic data releases will move the market in the week to come. This week however, I think that political and central bank speeches are more likely to be the catalysts for market moves. Now that Donald Trump has moved into The White House, traders will be monitoring how quickly he begins to lay out his agenda for his term in office. The weekend saw considerably more focus placed on the number of people attending the inauguration, rather than the text of the speech. Also on Monday, the European Central Bank’s President Mario Draghi will be speaking.

Tuesday will see many of the major European countries and the US updating the markets on the current manufacturing and service data. The UK however, will be focused on the outcome of The High Court’s ruling on the government’s ability to bypass parliament and initiate Brexit by triggering article 50.

Wednesday and Thursday will see US oil inventories and US unemployment claims, while Friday will see a Chinese Bank holiday in Asia and the release of US core durable goods orders. Friday will see the release of the latest Eurozone M3 money supply figures.

Corporate Releases

This week’s corporate releases will cover a very broad array of sectors from both European and US companies. Considering the fact that the US has a new President in power and one who is likely to have a completely different focus from Barack Obama, the market may well partially discount many of the sales and revenue figures as they will be only too conscious that the corporate landscape in the US could dramatically change in the next 4 years.

Interestingly, energy, biotechnology and technology sectors are some of the most likely to see changes under Trump administration and with the likes of Halliburton, Honeywell, Chevron, Biogen, Verizon, Alphabet & Microsoft all reporting, we might get an early take on how positive trader sentiment towards them is.