SYNOPSIS OF THE WEEK

- Hawkish comments from last weeks FED minutes suggest the US might see more than just three rate rises during 2018, boosting the US Dollar and spooking equity markets.

- Traders have spent the week acclimatizing to the increased volatility in the markets as the bulls try to build up their confidence following the recent equity market correction.

- Modest gains in equity markets continue to see the indices slowly climb back up towards their 2018 highs.

PRESS COVERAGE

On Wednesday 21st February Fern Wealth Head of Investment Management Alastair McCaig spoke with Bloomberg anchor Jonathan Ferro and FX and Rates Strategist Richard Jones. On this weeks show they discussed the bond market moves equity markets and the state of the UK banking sector.

Click here to listen to the interview on Bloomberg.

We stated markets would gradually look to climb back to their pre-correction levels before ultimately building up to set higher highs in 2018. We also said we expect to see more market volatility before we could break above this year’s early highs. The last seven trading days have certainly seen equity markets struggle to get to grips with a rise in volatility as the intraday ranges have widened. As the analysis of where we should expect markets to move in the near future has become increasingly polarized, it has added to the uncertainty of the retail investor. We remain convinced that markets will once again begin to head higher and that we should expect to see 2018 set higher highs that were achieved during 2017. That being said, we do not expect this trajectory to be in a straight line and remain prepared for pullbacks.

Over the course of last week, we have heard the latest views from both the US Federal Reserve and from the European Central Bank. In both instances, they highlighted an improving underlying economic environment and a desire to continue to head towards rate normalization. The US FOMC has already seen signs that the recent Trump Tax reforms have improved manufacturing orders and increased business investment and these benefits should further pay off over 2018. When taking these central bank statements onboard, it is worth remembering that they are tasked with looking at the long-term economic environment rather than any short-term market choppiness.

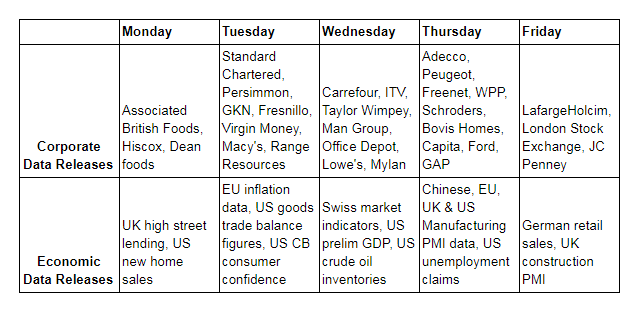

This week will be an important week for economic data releases as we will get reports on EU inflation on Tuesday. Oil prices continue to climb and Wednesday’s US oil inventories data will show how quickly the US shale oil supply can be escalated. Thursday will be the most important day of the week as we will hear Manufacturing PMI data releases from China, the EU, the UK and the US. Later on in the day, we will also see the latest US unemployment changes.

Last week, the British government held crisis discussions to thrash out a clear list of criteria they would be working on in future Brexit negotiations. We are expecting the British Prime Minister Theresa May to make a speech on Friday to clarify this to the public. The finer points of this announcement will directly affect the value of the British Pound and subsequently the value of FTSE equities.

Corporate releases

This week’s corporate releases are again more heavily weighted to European companies as the US reporting season comes to an end. Almost the full range of sectors will be covered this week with announcements covering Finance, Food retailers, Miners, Pharmaceuticals and even the London Stock Exchange itself. Considering how impressive corporate updates have been so far this year, we will be looking for more of the same.

Image by Gerd Altmann from Pixabay