Synopsis of the week:

- Angela Merkel is still to cement her coalition party but this uncertainty has been dismissed by traders as the DAX again sets new highs, briefly breaking above 13,000 during Friday’s trading.

- On Friday, US Non-Farm payrolls fell by 33,000 partially due to the effects of Hurricanes Harvey & Irma. This fall is the first time US jobs have shrunk since October 2010.

- Theresa May already struggling to find support from core Conservative voters delivered a car crash of a speech at the party conference. Being handed a P45 by one comedian, losing her voice halfway through the speech and the sign behind her falling apart. As analogies of how her tenure as Prime Minister is going, this was particularly harsh.

Press Coverage

On Wednesday evening, Alastair McCaig Director of Investment Management at Fern Wealth joined Bloomberg host Jonathan Ferro and Richard Jones where he discussed British Prime minister Theresa May’s speech at the Conservative party conference, the EU’s €250 million tax bill for Amazon and the events in Catalonia.

Click here to listen to the interview on Bloomberg

The month of September and the first week in October have been good for many of the big equity markets. The S&P 500 is up over 3%, the DAX up 7.27% and the EuroStoxx 50 up 5.16%. Even the FTSE held gains despite the uncertainty surrounding Brexit and the volatility of Sterling and it is heading back towards the highs of the year. Equities have remained resilient, undeterred by the last six weeks seeing numerous global events materializing such as the developments in North Korea, hurricanes hitting America and the Caribbean, earthquakes in Mexico and civil unrest in Spain. Although worries about equities being overvalued persist, now that we are into the final quarter of the year, optimism has once again picked up and momentum is still moving the markets higher. Until we can see some meaningful catalysts that will revert this move, we will continue to stay long of performing sectors.

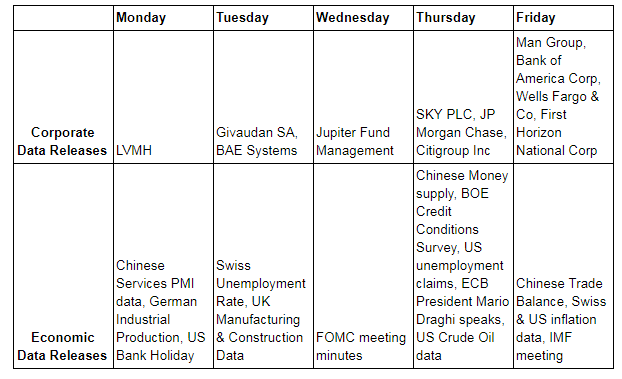

Next week might well be a short one for the US as they celebrate Columbus Day Bank Holiday on Monday but it will still pack quite a punch. Wednesday will see the release of the minutes from the last FOMC meeting where the Federal Funds Rate setting team discuss issues affecting the level at which to set interest rates. Thursday and Friday will see the first of the major US banks reporting figures with JP Morgan Chase, Citigroup, Bank of America and Wells Fargo setting the benchmark for the rest of the sector. Some of the initial excitement surrounding higher interest rates and the better profit margins available for banks has subsided as rates have not climbed as quickly as initially envisaged. More broadly, this quarter of earnings data out of the US is expected to be much weaker than the previous two quarters. It will be interesting to see how much of an added boost US companies reporting will receive from the poor performance of the US Dollar.

The International Monetary Fund (IMF) will on Friday convene for one of their bi-annual meetings. Following last week’s report detailing the risks of mounting global household debt, we expect this to be one of the main themes of conversation this year. IMF chief Christine Lagarde is also likely to use this as another opportunity to encourage reforms to job creation and fostering inclusive growth. As independent analysis on how economic regions are performing and expectations of how they perform in the future, these reports do have the ability to move underlying equity markets and as such will be monitored by investors.