Synopsis of the week

- The EU and US agreed to progress with tariff talks and resolved to prevent an escalation of tit for tat tariff increases.

- Over halfway through the US reporting season and S&P 500 corporate profits are up almost 25% year on year and look set for the second quarter of 20% plus growth in a row.

- Facebook’s disappointing figures and subsequent 20% fall in value ensured that the NASDAQ continued to underperform the broader equity markets over the last couple of weeks.

Press coverage

On Wednesday evening, Alastair McCaig, our Head of Investment Management joined Bloomberg anchor Jonathan Ferro and Richard Jones, FX & Rates Strategist. In this week’s show, they discussed tariffs and Jean-Claude Juncker’s trip to Washington, Deutsche Bank latest figures and the passing of Sergio Marchionne.

Click here to listen to the interview on Bloomberg

We have now seen figures from over 50% of US companies. The headline data shows that so far those companies in the S&P 500 have seen profits grow on average by 24.6%. This suggests that we could see profits grow by more than 20% in both of the last two quarters. As was the case in the last quarterly reporting season, sales are again one of the leading reasons why companies have managed to grow their profits. So far this season, corporate sales are up by almost 10% and this suggests that the economic backdrop of the US economy remains good. As we stated at the end of the last reporting season, it is a very encouraging sign to see profits being driven or maintained by increasing sales numbers rather than cost-cutting measures. Over the last three months, we have continued to see unemployment figures in the US and Europe drop and average hourly earnings increase. This points towards more people working and having more money to spend.

Of course, not all companies that have reported so far have impressed the markets and Facebook has been the biggest disappointment. The company has had its fair share of negative news this year with the Cambridge Analytica scandal testing investors’ confidence. These corporate figures however saw the company lose US$119 billion in market cap in just one day, the single biggest drop in the value of any company ever.

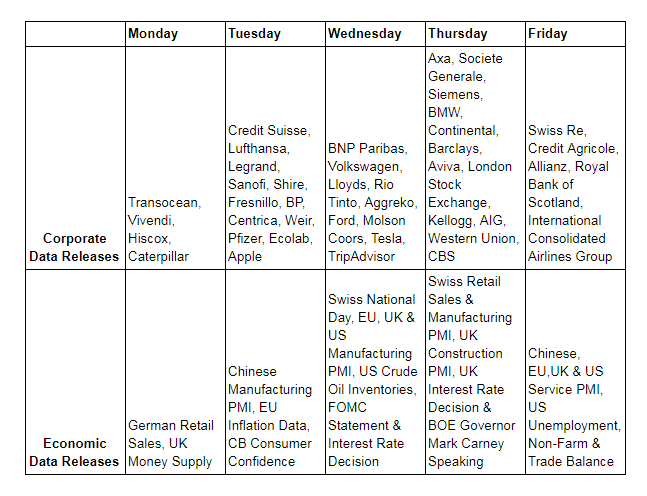

This week will again see a number of companies reporting figures including some of Europe’s largest companies such as Credit Suisse, BP, Volkswagen, Société Générale, Barclays, Swiss Re and Credit Agricole. With last week’s summit at the White House easing worries over tariffs, this could be an opportunity for investors to re-focus on the fundamental data coming out of the markets. Along with the plethora of corporate newsflow, we will also be hearing from the Japanese, US and UK central banks who are all due to give guidance on interest rate paths. Throughout the week, we will also get both Manufacturing and Service PMI data from the US, UK, EU & China.

The combination of important corporate data releases, Central Bank updates and barometers for economic health in the major investment regions of the world has the ability to move markets especially as trading volumes will be lower than normal due to the holiday season.

Image by JamesDeMers from Pixabay