Synopsis of the week

- Following the Assad regime’s use of Chemical weapons in Syria, Western forces successfully took out the infrastructure for their manufacture reportedly with minimal collateral damage.

- Conciliatory words from Chinese leader Xi Jinping last week have helped ease worries over trade wars between themselves and the US.

- Crude Oil continues its steady climb higher with prices breaking above January’s highs hitting $67 a barrel, levels not seen since December 2014.

Press coverage

On Wednesday 11th April our Head of Investment Management Alastair McCaig joined Bloomberg anchor Jonathan Ferro and FX and Rates strategist Richard Jones. On this week’s show, they discussed potential U.S airstrikes in Syria and how the markets had reacted to this news, UK manufacturing, along with U.S sanctions for Russia.

Click here to Listen to the interview on Bloomberg.

Once again investors will be focusing their attention on geopolitical issues rather than either corporate or economic data. This weekends strikes were specifically targeted towards chemical weapons facilities and did not put Russian personnel in harm’s way. Although this is unlikely to be the end of military action inside Syria it does not look like triggering an instant escalation.

The narrative for most of this year has been very similar, short-term political and social events have dominated investor thinking and stopped long-term investors from taking control. Social media interaction from US President Donald Trump has been the catalyst for many of the jittery market jumps we have seen. His opinionated comments, invariably during the early stages of discussion have stoked investors concerns leading to increased volatility. Analysing this from a technical point of view we have seen 27 volatile days of trading so far during 2018 this compares with just 8 in the whole of 2017. As investors become more accustomed to this “new norm” it is likely the equity market reactions will become less volatile and also subside more quickly.

Last week saw oil prices flirting with the $70 a barrel level. This is both a technical and a psychological level and with events in Syria it is possible that we have seen the high in this commodity certainly for the short term.

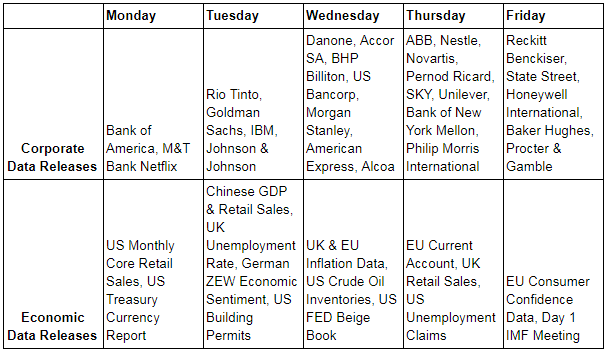

Corporate data

The last six weeks have seen a scarcity of corporate data releases but with the start of the second quarter reporting season now upon us, investors will at least have something else to focus on. This could be one of the most interesting reporting seasons we have seen in years as we should begin to see some of the benefits of last years Trump tax reforms being stated in releases. We are also going to be paying close attention to which companies announce increases to either their share buy back programmes or dividend payment schemes. These factors could help breath new life into the US equity markets. Financial institutions dominate the first week with Bank of America, Goldman Sachs, US Bancorp, Morgan Stanley, American Express, Bank of New York Mellon and State Street all releasing data. With US interest rates set to rise further this year and the new head of the FED Jerome Powell steering the economy in a similar style to the previous chair Janet Yellen, US financial equities have remained an attractive destination for US investor funds. Thursday will be a big day for Swiss equities as three of the biggest companies on the exchange ABB, Novartis and Nestle will all be reporting figures.

Photo by Sophie Keen on Unsplash