Synopsis of the week

- Equity markets suffer a negative week as worries over geopolitical issues outweigh good corporate earnings.

- The US banking sector continued its impressive performance with Goldman Sachs, Bank of America and Morgan Stanley all posting impressive figures, helped by both rising interest rates and US tax reforms.

- EU antitrust regulators hand out its largest fine ever to Google of €4.2 Billion after last years fine of €2.4 Billion.

Press coverage

Alastair McCaig, our Head of Investment Management joined Amanda Kayne on CNN Money Switzerland to discuss rising trade tensions between the US and the rest of the world, US President Trump’s meeting with Russian President Vladimir Putin and the latest developments with Brexit.

Click here to View the interview on CNN Money Switzerland

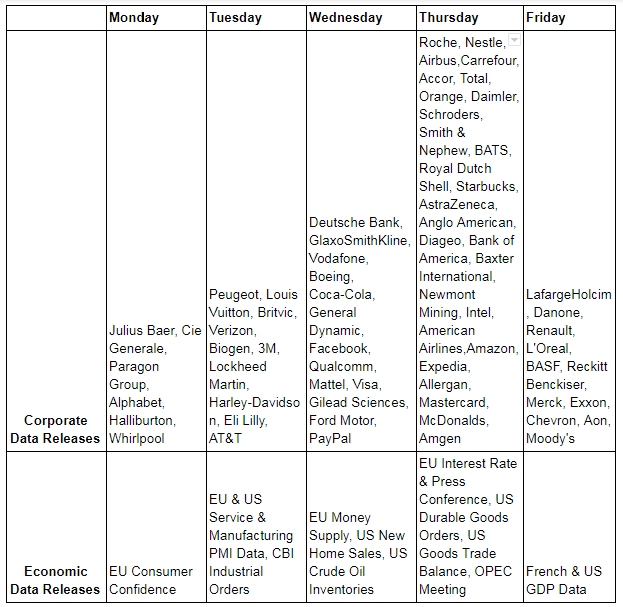

This coming week will see a substantial percentage of US companies updating markets with their quarterly figures. Along with the heavy weighting of US companies posting figures, we will also be getting data from some of Europe’s most important companies such as Deutsche Bank, Nestle, Roche and Carrefour. Equity markets have broadly managed to move laterally since the last equity reporting season and if we are to see a return to January’s highs, impressive quarterly earnings will go a long way to making that happen. Most of the headlines investors have had to absorb over the last three months have been geopolitical, while the economic data releases have been pushed to the back of investors’ agendas. Like the last quarter, we expect that sales will continue to be the driving factor for US companies profitability, especially as US unemployment levels have dropped even lower and average hourly earnings have increased. On top of more people working, earning more money and subsequently improving consumer spending, we still see ongoing benefits from last years Trump Tax reforms helping companies too.

Last week, US Fed Chairman Jerome Powell confirmed the FOMC’s desire to continue increasing interest rates in the US. We have previously stated that the higher interest rates would have a knock on effect to emerging market manufacturers who predominantly have short term financing in US Dollars. This combination continues to worry us about the emerging market sector, ensuring we remain underweight exposure to these countries.

When looking at the strength of the Swiss franc, we normally use the EUR/CHF as the benchmark currency cross. Having hit the 1.2000 level in April, the Franc has strengthened bringing the rate down to 1.1650 It is still our belief that the longer term future of this currency cross will see it break above the SNB’s previous peg level of 1.2000 and head up towards 1.2400-1.2600. Last week, the ECB confirmed they would be keeping its monetary policy weak and this statement suggests they will not raise rates before the summer of 2019 at the earliest. Considering the statements the Swiss National Bank have previously made about the Franc being too strong, it seems highly unlikely that we will see rates in Switzerland increase before the start of 2020 at the earliest.

Photo by Daniel Lloyd Blunk-Fernández on Unsplash