Synopsis of the week

- Last week saw both the Nasdaq and the FTSE hitting all-time highs and move into overbought territory.

- The week’s volatility in Sterling reflected the increasing fears the markets have that Theresa May will not win with a convincing majority.

- The US stand alone as Donald Trump exits the Paris climate accord further isolating himself following last weekend’s G7 meeting.

- US Non-Farm payrolls again fell short of expectations leaving economists disappointed but unlikely to revise expectations for a US Fed rate rise later in the month.

Press Coverage

Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s US news anchor Jonathan Ferro and senior FX Strategist Richard Jones for his weekly half-hour show. This week they discussed the latest comments from ECB President Mario Draghi, the aggressive moves in GBPUSD triggered by the latest UK election polls and the increased appeal of investing in Europe over the US.

Click here to listen to the interview on Bloomberg

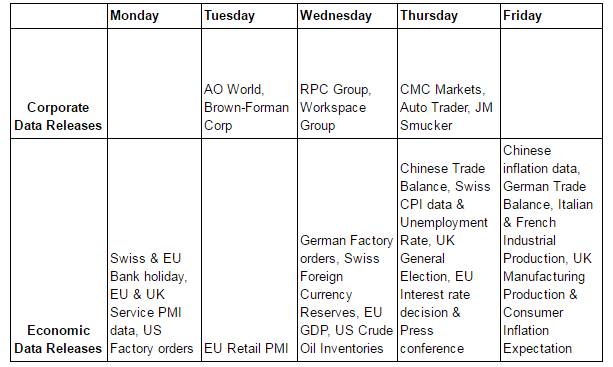

The Week Ahead

Economic Data

Following last weekend’s G7 meeting in Italy, it became abundantly clear that a growing divide was forming between the US and the other members. This contrast in global views being exemplified by the fact the US President Donald Trump has now removed the country from the 2015 Paris climate accord. In financial terms, the biggest beneficiaries of this are the US coal manufacturers, with the biggest losers likely to be the next generation.

When the UK General election was called by Theresa May and the Conservatives a month ago almost everyone felt it would be a landslide victory for them. That was a long time ago and the Conservatives have seen their lead in opinion polls steadily diminish to the extent that political observers are now asking if they will be able to have a majority or end up looking to form a coalition. Initially, this was seen as creating a strong Conservative government which would have given them a solid base to negotiate a Brexit deal with the EU. As this perception has diminished so has confidence in Sterling. In contrast to this, the FTSE has flourished as Labour’s stance on Europe is softer and less likely to see a hard Brexit, something that would be good for businesses.

A week is a long time in politics and the voting does not take place until Thursday 8th June.

Thursday will also see the European Central Bank announce its Interest rate decision. This is unlikely to see any change but the accompanying press conference with ECB President Mario Draghi could well point towards what they will do with the current QE stimulus scheme. Expectations are we will see a continuation of this into 2018 but with a possible reduction to the current €60 million being pumped into debt markets a month

The standout equity market in recent weeks has been the Nasdaq as the big five of Facebook, Alphabet (Google), Amazon, Netflix and Apple have all seen their shares climb by between 25% and 33%. This has seen a succession of new all-time highs being created and helped the Nasdaq climb by over 29% in the last twelve months.

Larry Fink who is the CEO of Blackrock stated during the week he now believes “Europe will grow as fast as the US if not faster this year” The difference between the two regions is the US markets have already priced in strong growth whereas Europe has not yet fully factored in the underlying strength in economic and corporate data.

US Non-Farm payrolls have come in weaker than expected with 138,000 jobs being created rather than the 181,000 that was expected. This is the weakest month the US job market has seen since June 2016. These figures will see the debate amongst economists increase but are not weak enough to change the expectation of an interest rate rise later this month. FX markets, of course, will price in less certainty of a rate rise so next week could see a softer US Dollar.

Corporate Releases

May and June are peppered with Bank holidays in the US, UK and EU and this seasonally sees less corporate data being released. The week ahead is another with limited corporate interest.