Synopsis of the week

- Theresa May’s General Election gamble fails in spectacular style leaving, even more, uncertainty hanging over the UK’s Brexit plans.

- The European Central Bank keep rates unchanged and President Mario Draghi paves the way for an extension to the monthly €60 billion stimulus scheme past its December deadline.

- Unexpectedly high Oil inventory figures out of the US have driven Oil prices back down to year lows as OPEC’s agreed reduction in production struggles to produce higher prices.

- A five-party Italian alliance to bring about electoral changes in Italy failed to force through amendments effectively pushing back any chance of a general election into 2018.

Press Coverage

Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s US news anchor Jonathan Ferro for an hour long show. Topics discussed this week included the ECB’s monetary policy meeting, Ex-FBI Director James Comey’s testimony the falling Oil prices and what to expect from next week’s Fed interest rate meeting.

Click here to listen to the interview on Bloomberg

The Week Ahead

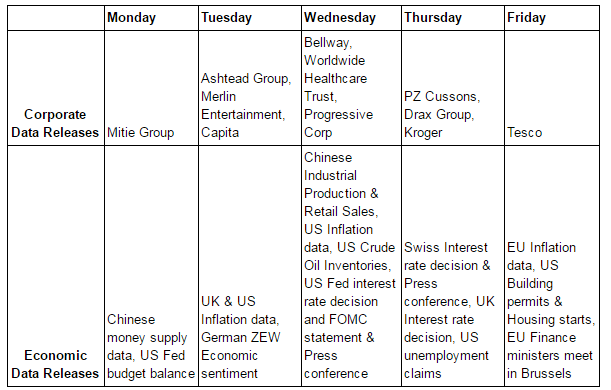

Economic Data

In the aftermath of the UK general election events on Friday took numerous twists and turns, none of them looking like long term solutions. This chaos saw Sterling collapse and with the weak currency, the FTSE 100 with over 70% of its revenue coming from outside the UK shot higher, while the more UK focused FTSE 250 fell away.

Europe has cleared another political hurdle this week or at least seen it move into 2018. A five-party alliance aimed at changing the Italian election structure has failed to hold. A number of the political parties had wanted to hold a referendum on staying in the EU and a delay to this process should improve European stability.

Wednesday will see the Fed announce their latest interest rate decision and the markets have been factoring in a rate rise of 0.25% for some time. What is more likely to have a bearing on currency and equity markets will be the accompanying statement and Q&A session. This should confirm to the market how many more US interest rate rises we might see in 2017.

Ex-FBI director James Comey made some very inflammatory claims about the US president Donald Trump during his testimony last week and we will be watching to see what the knock-on consequences are. Yet more distractions for the Trump administration are certainly the most obvious result.

Thursday will see the Swiss National Bank announce its interest rate decision. Markets are not expecting an increase to the negative -0.75% currently in place but with the SNB President Thomas Jordan recently being quoted as saying “the franc is still overvalued, which is why negative interest rates and our readiness to intervene in the forex markets remain necessary” this might not remain the case in the future. Fern Wealth remain convinced that EUR/CHF will in the coming weeks and months head higher. This current situation still offers Swiss Franc earning expats an excellent opportunity to take advantage of the currently strong currency, especially if they will ultimately reside outside of Switzerland.

Once again it will be a thin week for corporate data releases but with Tesco, Bellway and Ashtead Group all reporting there are a few things to keep an eye on.

Image by Candid_Shots from Pixabay