Synopsis of the week

- A week after coming out with a strongly Dovish statement calling for no change in rates, the Bank of England Governor has now made a strongly Hawkish announcement suggesting rate rises could be on the way, shooting Sterling higher.

- European Central Bank President Mario Draghi’s speech in Portugal has hinted towards further reductions in stimulus sending EURUSD 2.2% higher in just over 24 hours.

- Fed Chair Janet Yellen in a Q&A session in London stated that US equity prices were “somewhat rich if you use some traditional metrics, like price-earnings ratios”.

- US Banks pass the latest stress tests, opening the door to the banking sector increasing dividend payments and share buybacks.

Press Coverage

Fern Wealth’s Director of Investment Management Alastair McCaig joined Bloomberg’s FX and Rates Strategist Richard Jones and host Jonathan Ferro for an hour long special. Discussing comments from ECB President Mario Draghi, BoE Governor Mark Carney and US Fed chair Janet Yellen and the implications for rate expectations and the FX markets.

Click here to listen to the interview on Bloomberg

The Week Ahead

Economic Data

Central bankers gave markets a serious jolt last week starting with the Bank of England Governor Mark Carney. Less than a week after he had stated that he was inclined to keep rates unchanged for the foreseeable future, he effectively had a complete turnaround. While giving his speech in Portugal to the other EU finance ministers Mark Carney was considerably more dovish on the prospects of rate rises in the UK. The fact that the Monetary Policy Committee MPC was split 5 to 3 to keep rates unchanged earlier in the month shows that those making the interest rate decisions do not have a unified opinion. The consequences of all this confusing data were GBPUSD has bounced by 3.5% in only the last 9 days.

The European Central Bank President Mario Draghi also spoke last week and the change in tone he used when discussing ECB stimulus packages also sent markets running, EURUSD was 1.45% higher within 24 hours. As the ECB shifts its strategy on market stimulus from “whatever it takes” to “rate normalisation” it was always likely we would see some aggressive moves along the way.

Last, of the big three Central Bank speeches, this week was US Fed Chair Janet Yellen, as she was questioned in London on US markets. Her opinion that “Asset valuations are somewhat rich if you use some traditional metrics like price-earnings ratios”. This statement, of course, could have been said by numerous people over the last five years but that fact that the US Federal Bank Chair is making it saw US equity wobble.

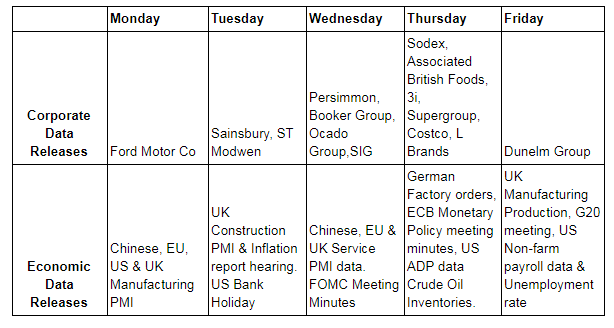

Tuesday will be the 4th of July Independence day holiday in America and as is normally the case Monday should be a quiet day too as many in the US will take the day off to create a four-day weekend. This week will be dominated by hard data. On Monday we will be able to digest Manufacturing PMI data from most of the major economic regions, while on Wednesday we will get releases of the Services PMI Data from those same regions. These two components tend to make up a large part of the economy of these countries and will help analysts review how the state of the economies are.

Later on Wednesday, we will also get the release of the last FOMC meetings minutes, enabling FX traders to see exactly what was discussed. FX markets are currently pricing in a 45% chance of another US rate rise in 2017, these minutes will decide if that is fair value or not.

The last thing on the weekly agenda is the US Non-farm payrolls data. Always announced on the first Friday of the month these are the previous month’s employment figures. Because of the speed with which they are calibrated they can often have large revisions and have historically been catalysts for volatility. Of course, lately, Central bankers and Trump tweets have kept uncertainty levels high enough.

Corporate Releases

Food retailers play a prominent role this week with Sainsbury, Booker, Ocado, Associated British Foods and Costco all posting figures. Many of these firms have the majority of their market share in the UK and the dual issues of rising inflation and a weak pound could see damage to both profit margins and profitability.