Synopsis of the week

- US Non-farm payrolls come in stronger than expected while average hourly earnings disappoint, leaving unemployment levels at 15-year lows.

- French Bank Societe Generale think “fair value” in EUR/USD should be around 1.20 by the end of 2017.

- The CAC continues to drift, now down 6.25% in the two months since its early May highs.

- UK Manufacturing, Service and Construction PMI data all disappoint as initial Brexit negotiations do little to ease UK economic worries.

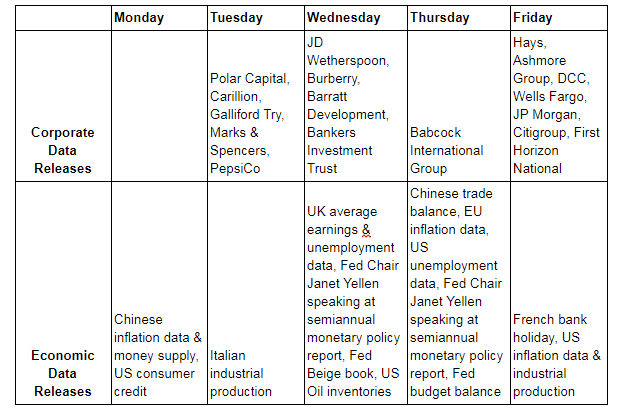

The Week Ahead

Economic Data

The last three weeks have seen market participants struggle to gauge a clear understanding of how central banks are viewing the economic landscape. Without this understanding, opinions on the likely course of actions Central Banks will take is polarised and subsequently giving to volatile swings in FX markets. A clear case in point is the conflicting comments that the Bank of England governor has made over the last couple of weeks. Not only has his opinion been in contrast with many of his fellow MPC Interest Rate voting colleagues, but from time to time he has also appeared to disagree with himself. Considering how disappointing the UK’s economic data has been over the last week this might partially account for his aggressive re-think.

Equity Markets in Europe and the US have drifted laterally and lower as trading volumes have reduced in the summer months and a political sense of direction has become less clear cut. Equity markets drifting lower can partially be attributed to seasonality and partially due to profit taking, as so many exchanges had been hitting all-time highs over the previous quarter.

We have noted a shift in institutional perceptions about the ongoing strength of the Euro. Over the last week, Societe Generale has published a note calling for EUR/USD to climb up to 1.20 from its current levels of 1.14 This is a clear reflection of the growing confidence in the Eurozone’s improving economic strength. It is less than 12 months since numerous banks were calling for parity between the US Dollar and the Euro. The last two weeks have also seen EUR/CHF climb from 1.0825 to 1.10 in conjunction with Fern Wealth’s view that the Swiss Franc is currently too strong and will weaken in the months and years ahead.

Last weekend saw the latest G20 meeting taking place in Hamburg Germany, although a G19 and America meeting might be an equally accurate synopsis of the weekend’s events. Climate change issues and North Korea dominated many of the meetings along with Russian leader Vladimir Putin and US President Donald Trump’s encounter.

Fridays non-farm payrolls came in much better than expected and the overall unemployment levels in the US continue to hold at 15-year lows. As positive as these are the average hourly earnings data does show how precarious a position the US Fed is in when deciding when and if to raise rates again in 2017. Inflation remains an issue being controlled with too many global factors outside the US’s control.

Corporate Releases

Friday will see Wells Fargo, JP Morgan, Citigroup and First Horizon National all posting quarterly figures. With the banks kicking off the latest US reporting season hopes will be high that they can start the ball rolling with good news. Only a week after the latest US Bank Stress Test results, where only one bank failed to get a clean bill of health, this has been a sector where investors will be hoping that share buybacks and increased dividend payments will now become a frequent announcement.

The technology sector has had a soft couple of weeks after being one of the biggest driving forces of US equity markets in the last six months. The second quarter revenue growth of the sector is expected to be 7.2%, faster than the S&P500’s projection of 4.6%. Last week saw Microsoft announce global restructuring and job cuts, only two weeks ahead of posting its second quarter earnings on the 20th July. Share prices of companies that cut jobs invariably behave well as jobs normally account for one of the largest costs any company has.