SYNOPSIS OF THE WEEK

- The Fed announces that it will start a monthly disposal of $10 billion of tradable debt in October as it begins shrinking its $4.5 trillion balance sheet

- Angela Merkel wins her fourth term as German Chancellor in Sundays general election paving the way for more EU stability over the next four years.

- Retail sales in the UK rose at their fastest rate in four months, far exceeding economists forecasts and meaning that the Bank of England may trigger its first interest rate increase in over a decade

THE WEEK AHEAD

On Wednesday, both UBS and Credit Suisse will produce their monthly reports of the current state and expectations concerning the future of Switzerland’s economy. These in-depth reports, apart from just containing data on the financial markets, also provide statistics on all monetary and economic affairs which are important for monitoring the economy as a whole. This data should help investors determine how close the Swiss National Bank was or is to further market intervention either by adding to its foreign currency exposure or increasing the negative interest rates.

Since the Swiss National Bank abandoned the 1.2 EURCHF peg in January 2015 and caused it to crash, the currency cross has been slowly edging its way back up. Last week saw EURCHF break above the 1.15 highs it set in early August. 1.20 was the level the SNB had previously set its peg at a level they were protecting it from falling below. The SNB have stated on numerous occasions over the last couple of years the Swiss Franc remains overvalued and we have every reason to believe this run still has higher to go.

The Bank of England’s governor will be questioned by parliament this week concerning the inflation rates which peaked at highs of 2.9% last week. As Alastair mentioned in last week`s Bloomberg interview below, the Governor’s primary mandate within the BOE is to keep inflation at 2%. The low interest rate has let banks charge low rates to their consumers who, in turn, have increased their borrowing at double digit rates. The inability of wage growth to keep up with inflation makes the case for the BOE to raise their national interest rates, and this hearing will give a clear indication as to how fast and by how much they will increase them, or indeed, whether they will be increased at all. Even though this will manifest in more expensive mortgages and credit card debt to the UK consumers, the Forex markets will reflect this change by seeing a strengthening of the Pound against the CHF.

In the United States, the Federal reserve announced that it would start the process of unloading its $4.5 trillion holdings in government and corporate debt it has been stockpiling since the crash in 2008. Despite the nation registering an annualised GDP growth of 3% this quarter, inflation is only forecasted to rise up to 1%, a vast difference from the 2% it was looking forward to hitting in 2018. The Fed has frequently stated that interest rate decisions will be driven by data and another set of strong GDP figures could help crystalize another interest rate move in December.

Press Coverage

Fern Wealth’s Head of Investment Management, Alastair McCaig, joined Bloomberg host Jonathan Ferro and FX strategist Richard Jones on Wednesday evening to discuss UK retail sales data, Emmanuel Macron’s speech in New York, and the Fed’s interest rate outlook and reduction of its $4.5 trillion balance sheet.

Click here to listen to the interview on Bloomberg

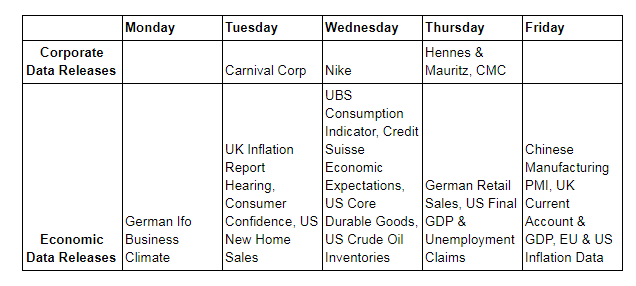

CORPORATE & ECONOMIC DATA RELEASES