Synopsis of the week

- The latest European Central Bank meeting and press conference confirmed what markets had suspected, that there will be no rate change and Mario Draghi has sidestepped the issue of QE tapering or extension until December.

- The latest US election debate once again offered something from the surreal to the ridiculous. Now that all three debates are out of the way, Democratic nominee Hillary Clinton has managed to hold onto her lead in the opinion polls.

- UK inflation jumps to 1% raising speculation that the 2% target is finally achievable especially as these figures were correlated without the full benefits of the collapsing pound being factored in.

- Nestle the Swiss food manufacturer has posted its softest underlying sales growth in more than a decade, as global currency fluctuations hit the company’s bottom line.

The Week Ahead

Economic Data

Last week inflation figures from around the world came in at higher levels than expected. Although aggressive fluctuations in various currencies might be the obvious reason for the improvement, it is actually the underlying long term shift in economic cycles. Most central banks have a 2% target, and once the movements in currencies work their way into these calculations we could see targets finally being hit.

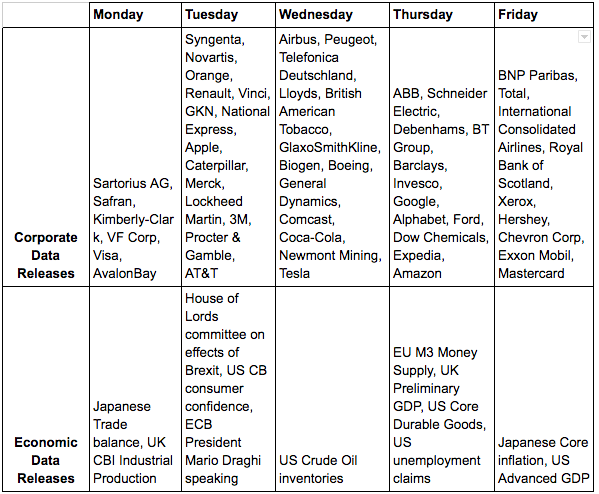

This week starting 24th October, we will see the focus shift onto the plethora of manufacturing and services PMI data releases due from major economic regions around the world.

We will once again see the House of Lords Economic Affairs Committee grill the governor of the Bank of England, Mark Carney about the economic consequences of the Brexit vote. These events have so far proven to be more political than economic and as the UK has still not triggered article 50, this event could follow in a similar trend.

Corporate releases

Last week the first of the banks posted figures, with Goldman Sachs the obvious star of the class while the managerial shake up at Wells Fargo only added confusion to the disappointing company news and regulatory issues.

The US reporting season kicks on this week with big names from all the major sectors reporting quarterly figures. Visa, Renault, Apple, Caterpillar, Lloyds, GlaxoSmithKline, Biogen, Tesla, ABB, Barclays, Alphabet, Amazon, BNP Paribas, Royal Bank of Scotland, Exxon, Mastercard.

Back in Europe there has been some interesting developments with food retailers, in particular a short lived feud between Tesco and Unilever, as the supplier tried (unsuccessfully) to impose a 10% increase on their goods sold at the UK’s largest food retailer.

Swiss giant Nestle have also made clear the consequences that the turbulent currency markets are having on their bottom line too Although the sizeable list of companies reporting this week will no doubt make for interesting reading, the currency markets continue to dictate the direction of many of the major equity markets. For the third time in the last seven months USD/CHF is flirting with breaking above parity. EUR/USD is also hitting fresh seven month lows, while the GBP/USD continues to hit new thirty year lows.