Synopsis of the week

- The FTSE 100, FTSE 250 & FTSE all share all hit intra-day highs on the same day for the first time since December 1999.

- Political statements continue to crush Sterling as GBPUSD hits a succession of new 30-year lows throughout the week.

- German business confidence figures came in much stronger than expected while Chinese exports drop for the first time in six months.

- Tesco pulls Unilever products as the supplier wanted to increase prices by 10% due to the inflationary pressures of the weak sterling.

- US FOMC minutes suggest that a rate rise is still on the cards as futures indicate a 67% move in December.

The Week Ahead

Economic Data

Political comments are targeting voters with tough talk on Brexit and these continue to put pressure on Sterling. This is likely to be the template for the next five months until the UK finally actions article 50. Donald Tusk the Polish President of the European Council, has been the most succinct in his analysis stating “The brutal truth is that Brexit will be a loss for all of us. There will be no cake on the table for anyone. There will only be salt and vinegar.”

Last week German business confidence levels come in much higher than expected, considering the volatility that has been around due to the Brexit.

This week Chinese export figures fell for the first time in six months. Up until now the performance of the Chinese economy has been one of the key drivers boosting investor confidence in 2016.

In the week ahead FX traders will be paying close attention to the inflation figures coming out of China, UK, EU and the US. The strength of the US Dollar should see inflation levels boosted in other nations.

Corporate releases

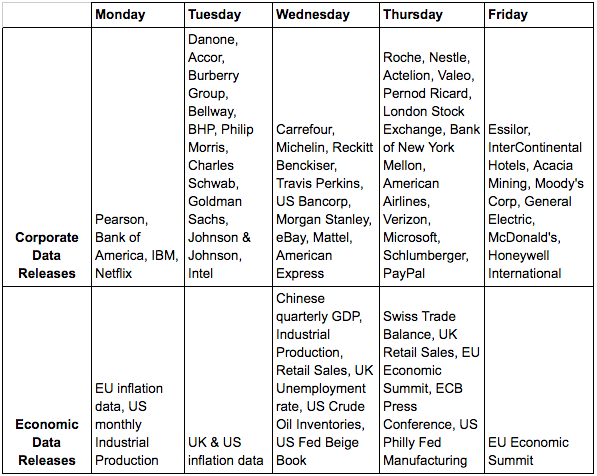

It’s been a disappointing start to the US reporting season as Alcoa’s figures came in well below expectations. This week the number of companies reporting increases dramatically, with the likes of IBM, Netflix, BHP Billiton, Goldman Sachs, Carrefour, Morgan Stanley, eBay, Nestle, Roche, Microsoft and General Electric to name just a few.

The vast majority of US companies report their quarterly figures at the same time during the year and so have a seasonal effect on the markets. Due to the large numbers of companies all reporting around the same time it tends to be just the outliers, those companies reporting particularly good or bad results that have large moves. The larger equity index moves tend to materialize closer to the end of the season.

Portfolio view

Weak sterling has given the equity index and the FTSE100 a boost, and we’ve enjoyed good results as a consequence.

The long mining and commodity positions that we had have been running have all worked out well and moved sufficiently to enable us to take profits off the table.

The combination of the FTSE100 hitting all time highs and Sterling hitting 30-year lows have seen most market watchers all looking in the same direction. It is in these instances that we become more nervous. The example of Unilever trying to force a 10% increase on their products stocked at Tesco is an example of how Sterlings weakness has forced inflation higher. This action could be an indication that we are reaching the tipping point when Sterling weakness will no longer be deemed as a positive but a negative.

With this in mind we are now actively looking to work some short positions as a hedge to equity markets running out of steam.