Synopsis of the week

- US Equity markets have eased off over the week as the initial boost from the US elections becomes more discounted.

- On Wednesday the US Dollar index hit a thirteen year high taking it back to April 2003 levels before stalling on Fed Chair Janet Yellen’s comments. This latest statement from the FED moved expectations of a December hike up to 90%.

- Shoppers on both sides of the Atlantic throw caution to the wind as retail sales jump in both the US and the UK.

- We are looking forward to hosting our first in-house seminar at our Zug offices on Tuesday 22nd November discussing the consequences of the US election for investors and the shifting political landscape of Europe in 2017. Contact Alastair@fernwealth.ch for further details.

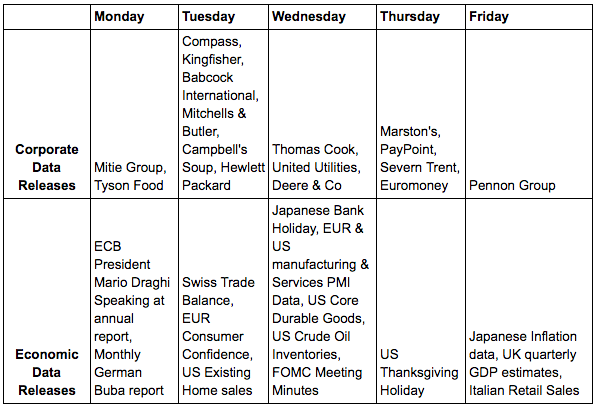

The Week Ahead

Economic Data

Political statements and commentary continue to be more closely scrutinised by the markets rather than the economic data releases. The US continues to watch President-elect Donald Trump as he creates his cabinet, a process that should shed a little more light on the actual direction that his term in office will take.

The takeaways we had from last week were that Fed Chair Janet Yellen is now 90% likely to raise rates in December. Judging by the retail sales figures coming out of the US and the UK the political turmoil has only added to the desire to shop. In Germany, the well watched ZEW economic sentiment figures had their 4th consecutive month of improvement suggesting a more robust economic outlook within the next 6 months.

Wednesday & Thursday could well be the pivot points of next week with Philip Hammond the new Chancellor of the exchequer delivering his Autumn speech on Wednesday afternoon. Leaked quotes have stated that he will be claiming the Brexit vote will require the UK treasury to find an additional £100 billion. Wednesday evening after the US markets have shut will see the FOMC posting the minutes from the last meeting. Interestingly this announcement will allow the rest of the world to react while US traders will have to wait a further 24 hours due to the Thanksgiving bank holiday in America on Thursday.

Corporate releases

Last week saw market updates from UK housebuilders Taylor Wimpey, British Land, Barrett Development and Land Securities all with a similar template to their results – historical sales had gone reasonably well but the ability to accurately gauge direction of the UK housing market is difficult as much Brexit uncertainty hangs over the market.

This conundrum as far as operational decision making is concerned has so far not dented sector performance too much. We will still have plenty of interesting company figures to digest this week. With strong retail sales figures, investors in the likes of Kingfisher, Hewlett Packard and Thomas Cook might be going into next week a little more optimistically.

The equity sectors that initially shot higher on the back of the US election results have spent the week cooling off. This is not necessarily a change in market perception more likely a retracement/consolidation to the over reaction we have already seen.