Synopsis of the week

- Resilient European flash manufacturing and services data helps ease investor worries.

- President-elect Donald Trump’s short video message confirms that infrastructure spending, trade agreements and regulation will be at the forefront of his plans when he takes office in January.

- UK Chancellor Philip Hammond still four months out from seeing Article 50 being triggered gave a cautionary Autumn budget. This was a statement lacking in detail that left observers underwhelmed.

- Retailers and shopaholics enjoy the latest “Black Friday” and “Cyber Monday” sales bonanza.

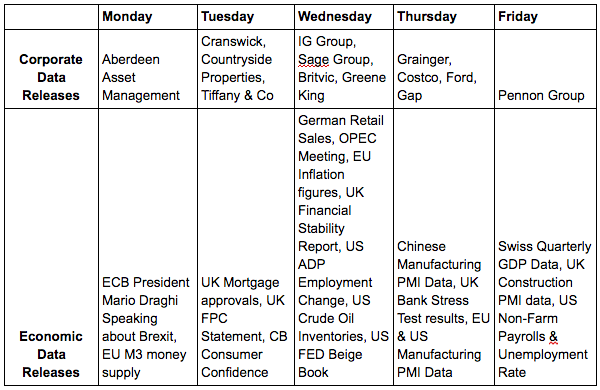

The Week Ahead

Economic Data

Considering the volatility that businesses have had to absorb over the last quarter, the flash manufacturing and services data that France, Germany and the EU have posted last week was particularly pleasing. Now the US elections are out of the way, the Italian vote on constitutional changes is the next political hurdle that European traders will be watching.

Although not really any clearer on the makeup of his cabinet, Donald Trump has released a short video that has confirmed expectations of what his priorities will be, as he takes office on the 20th January 2017. Specific references to infrastructure spending, withdrawing from the current Trans-Pacific Partnership Agreement, reducing regulations and cleaning up Capitol Hill.

We are still a week away from OPEC’s annual Vienna meeting, and we are already hearing wildly conflicting sound bites from the various member Oil ministers due to attend. Considering how disjointed their thinking is, I’m finding it increasingly difficult to call them a cartel. Oil continues to find $50 a significant area of resistance and until OPEC show conviction to a unified stance or demand rises, this looks set to continue.

The first Friday of December will again see the all-important US Non-Farm payroll figures being released. This, along with hourly earnings, could be the only thing that prevents an interest rate rise being announced by the FOMC later in the month.

Corporate releases

On the corporate front, we find ourselves in between reporting seasons with only a limited number of companies updating the market. Rather than individual equities, it will once again be sectors that we’ll be watching, as the initial boost that several sectors received from the Trump win, eroded almost as quickly as it materialised.