Synopsis of the week US equity indexes head higher as expectations that the Dow will hit 20,000 before the end of the year grow. The European Central Bank decide to extend quantitative easing from March until December 2017 but reduce the monthly spending from €80Bn down to €60Bn. FX Markets look ahead to an almost fully factored in December interest…

Synopsis of the week European traders prepare for Italian referendum disappointment and increased instability. European equity markets start December with a whimper, not a bang. The China 300 recovery is almost complete eleven months after regulatory intervention triggered its collapse. OPEC agree on a deal. (reliant on Non-OPEC nations agree to action too at their meeting next weekend). The Week…

Our Director of Investment Management Alastair McCaig comments on Dukascopy TV. He looks at the shift in Investor focus from US to European politics as the Italian constitutional referendum is now just over a week away. Friday will see the latest US Non-Farm Payrolls probably the final hurdle that needs to be cleared before a December US interest rate rise….

Weekly Roundup & Look Ahead: A week of calmer markets as traders become accustomed to the new normal

Synopsis of the week Resilient European flash manufacturing and services data helps ease investor worries. President-elect Donald Trump’s short video message confirms that infrastructure spending, trade agreements and regulation will be at the forefront of his plans when he takes office in January. UK Chancellor Philip Hammond still four months out from seeing Article 50 being triggered gave a cautionary…

Synopsis of the week US Equity markets have eased off over the week as the initial boost from the US elections becomes more discounted. On Wednesday the US Dollar index hit a thirteen year high taking it back to April 2003 levels before stalling on Fed Chair Janet Yellen’s comments. This latest statement from the FED moved expectations of a…

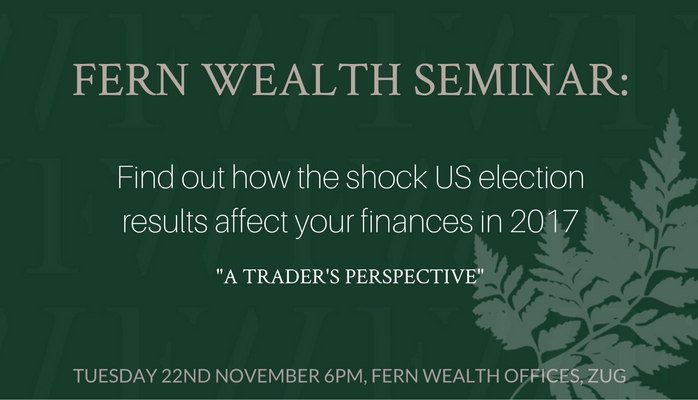

Synopsis of the week The initial panic seen in Asian trading as a Republican victory became increasingly likely was swiftly replaced by optimism as traders looked forward to the US spending their way out of trouble. Biotechnology, pharmaceuticals, energy and construction sectors lead the way in the aftermath of last weeks political developments. Companies with businesses inside the US rallied…

Synopsis of the week The Financial world looks to have implemented the harsh lessons that they learnt following the Brexit result earlier in the year with an aggressive “risk off” mindset dominating traders thinking ahead of this week’s US Presidential election results. Central Banks resist the temptation to change, ahead of a momentous week leaving December the month when gifts…

Expect central banks to delay major decision-making even after the United States’ presidential election, says Alastair as he talks with Bloomberg’s Markus Karlsson and Daybreak Europe’s Caroline Hepker. They also discuss why Alastair expects the next Federal Reserve rate hike to be in December. Click here to listen to the interview on Bloomberg.

Synopsis of the week The latest European Central Bank meeting and press conference confirmed what markets had suspected, that there will be no rate change and Mario Draghi has sidestepped the issue of QE tapering or extension until December. The latest US election debate once again offered something from the surreal to the ridiculous. Now that all three debates are…

Synopsis of the week The FTSE 100, FTSE 250 & FTSE all share all hit intra-day highs on the same day for the first time since December 1999. Political statements continue to crush Sterling as GBPUSD hits a succession of new 30-year lows throughout the week. German business confidence figures came in much stronger than expected while Chinese exports drop…